Thesis

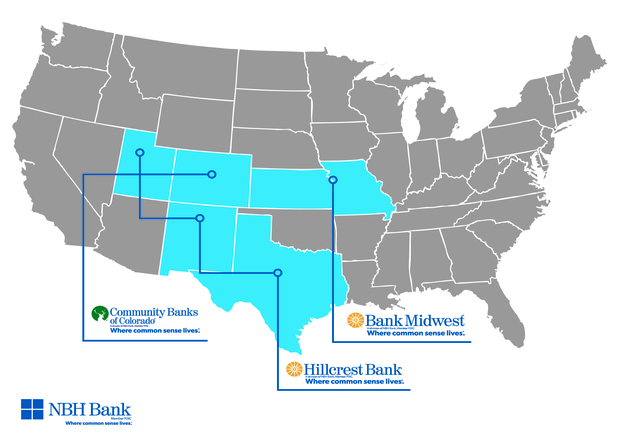

National Bank Holdings Corporation (NYSE:NBHC) is a small (~$780 million), Denver, Colorado-based regional bank holding company that owns and operates three banks: Community Banks of Colorado; Bank Midwest in Kansas and Missouri; and Hillcrest Bank in New Mexico, Texas, and Utah. Its network of 101 banking centers are concentrated mainly in Colorado and the greater Kansas City area.

NBHC has been a fast-growing company during the bull market from 2010 to 2020, acquiring 6 banks during that time period. Its primary focus is on serving small to mid-sized businesses in its core markets. And though it may not be a large tailwind, NBHC also enjoys status as a preferred lender with the Small Business Association ("SBA"), through which it should see some benefit in collecting fees from Paycheck Protection Program loans.

Dividend growth has been very fast for this small bank holding company. If it can successfully navigate the difficulties of the current crisis for its sizable small-to-mid-sized business loan portfolio, NBHC could make a strong dividend growth investment going forward.

The Company

Of NBHC's 101 bank locations, 48 are located in Colorado, 44 in Kansas and Missouri, six in New Mexico, two in Texas (Dallas and Austin), and one in Utah (Salt Lake City) as of the end of 2019.

Source: National Bank Holdings IR website

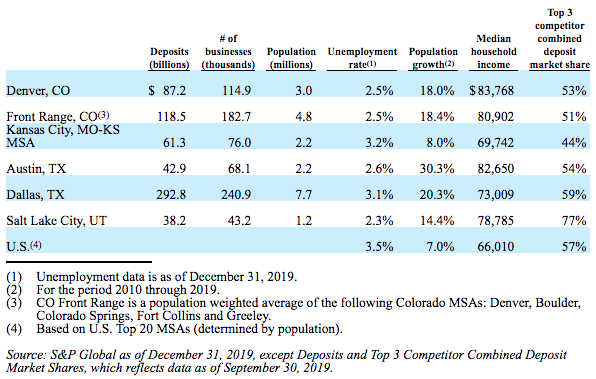

These core and expansion markets are some of the faster-growing metro areas of the United States.

Source: NBHC 2019 10-K

NBHC's total loans of $4.4 billion and total deposits of $4.7 billion together represent a loan-to-deposit ratio of 0.94x (or loans amounting to 93.6% of deposits). The loan book makes up 75% of assets, while non-interest income actually makes up slightly over 28% of total revenue. This is up from 12% of revenue at the end of 2015.

In the last five