Introduction

The scope of this article is to analyse Bitcoin (BTC-USD) position in monetary economics and as a mean of fiat currency hedge. Despite critics arguing that Bitcoin’s value will eventually go to zero, I find that economic projections favour Bitcoin as a store of value as opposed to fiat currency. I run three scenarios to evaluate possible Bitcoin’s price in the short term. Following the analysis, the projections show a price range between $5000 and $57000.

Bitcoin As A Hedge Against Inflation

Purely from an investor perspective, and excluding what the technology could bring to society, Bitcoin could find space in a diversified portfolio as a hedge against inflation. In troubled times in history, the typical monetary response pursued by governments has been a capital injection into the financial system. This “quantitative easing” has the goal of financing business activities in the short term, hoping to achieve an overall economic stimulus.

Recently, governments and central banks around the world have been injecting money into the financial system to avoid a coronavirus-induced collapse. The US alone has agreed to a stimulus package of over 2 trillion, the largest economic stimulus in US history.

Capital injections policies produce benefits in the short term, but come prepackaged with predictable consequences long term. The main one is an increase in inflation.

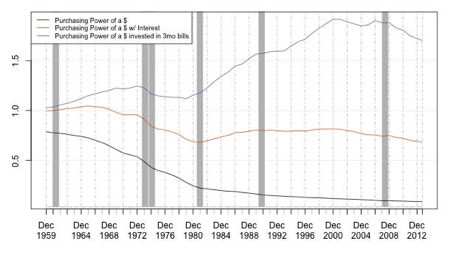

Figure 1

(Source: Business Insider)

It can be seen (Figure 1) that the purchasing power of a dollar (dark line), even if reinvested (yellow line), is significantly decreasing over time. The purple line (top line, $1 invested in 3-month bills) in the graph is set to continue its decreasing trend, following the decrease in interest rate that we are have experienced, and will experience, for at least a few years. The cost of holding cash is therefore increasing, and even the purple line is set to approach the yellow line over time, before continuing in synchrony in a