Many investors think the market is acting a bit crazy right now.

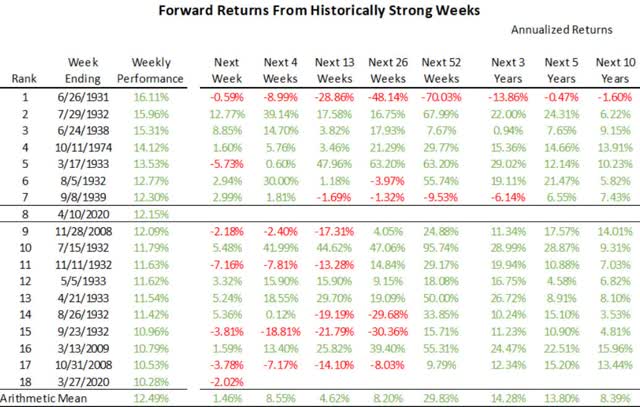

Last week we saw the S&P 500 soar 12% in four days, the 8th best week in market history.

(Source: Ycharts)

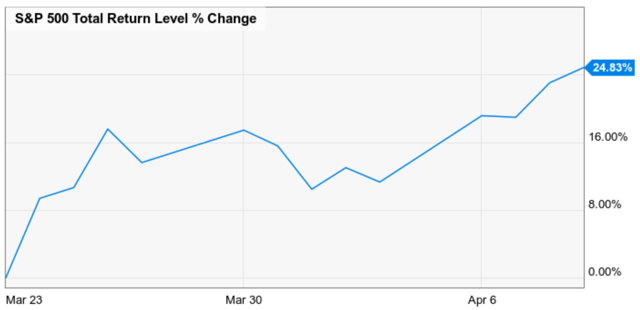

Since bottoming (so far) on March 23 (at -35% from the peak, intra-day) the broader market surged 25% in a matter of two weeks.

During periods of high uncertainty, investors are often balanced on the knife-edge between fear and fear of missing out. That's what causes both panic selling and panic buying.

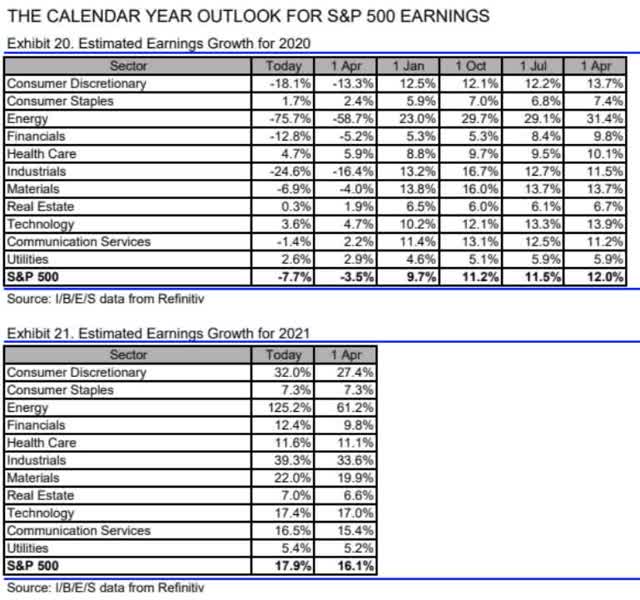

Earnings expectations have fallen off a cliff in recent weeks, as one would expect when about 30% of the US economy (according to the Bureau of Labor Statistics) has shutdown.

Since the start of the year, the 2020 consensus EPS forecast has fallen by about 18% and individual analyst estimates for earnings this year range from about -35% to -15%.

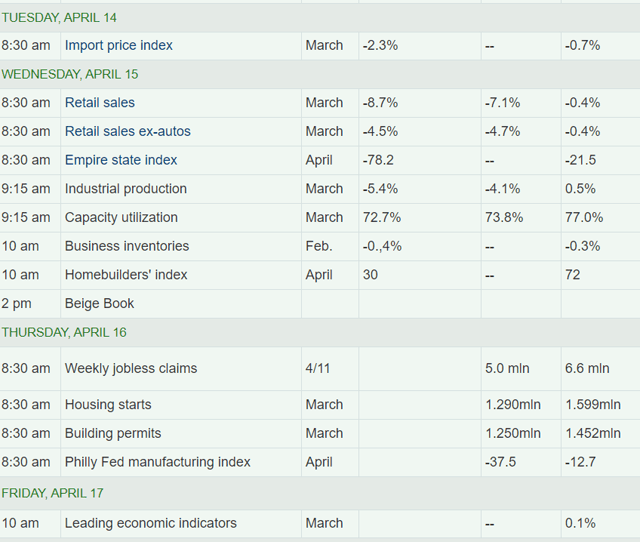

The economic news coming in each week is likely to steadily get worse.

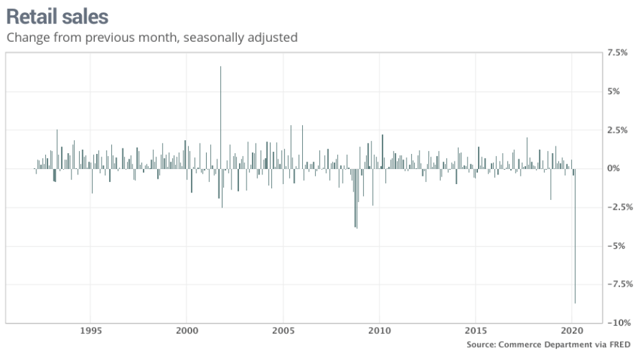

(Source: MarketWatch)

Retail sales last month fell by 8.7%, almost three times the previous record set back in November 2008.

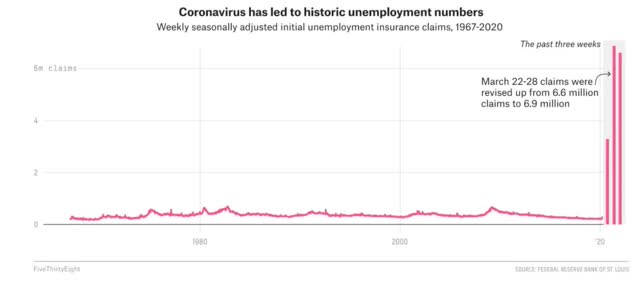

(Source: MarketWatch)

New unemployment claims have reached such proportions as to boggle the imagination, 17 million in three weeks.

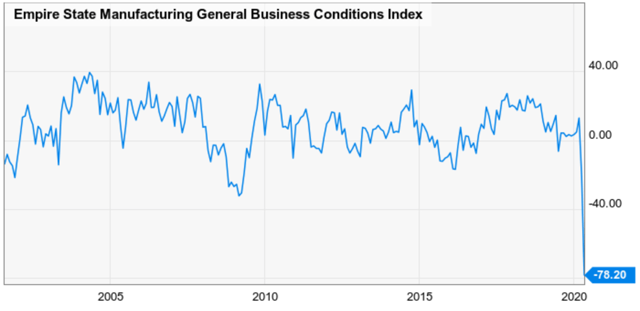

The Empire State Index, which measures North East manufacturing, fell a record 57 points last month.

(Source: Ycharts)

Manufacturing has never been in worse shape. Severely depressed demand, supply disruptions, and extremely high uncertainty will keep manufacturing on an extremely weak trajectory in the near term.” -Oren Klachkin, Oxford Economics

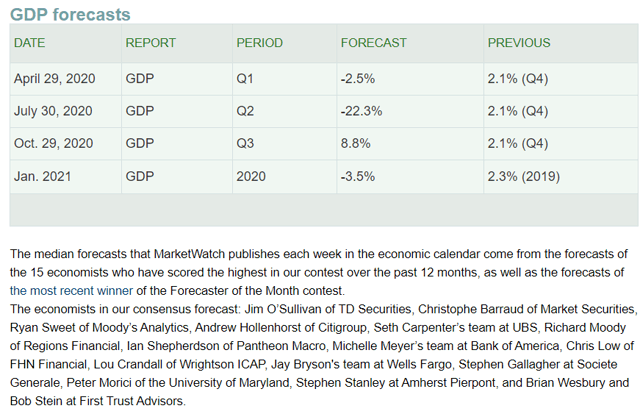

The blue chip economist consensus, consisting of the 16 most accurate economists, keeps getting worst each week.

(Source: MarketWatch)

The Q2 contraction is already expected to be more than double the 1958 single-quarter record of -10%. And while Q3's bounce back is expected to be strong, we're still expected

---------------------------------------------------------------------------------------- Dividend Kings helps you determine the best safe dividend stocks to buy via our Valuation Tool, Research Terminal & Phoenix Watchlist. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Valuation Tool, Research Terminal & Phoenix Watchlist. Membership also includes

- Access to our five model portfolios

- Daily Phoenix Portfolio Buys

- 30 exclusive articles per month

- Our weekly podcast

- 20% discount to F.A.S.T Graphs

- real-time chatroom support

- exclusive weekly updates to all my retirement portfolio trades

- Our "Learn How To Invest Better" Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.