EOG: A Diamond in the Rough

The party is finally over. After a decade-long, credit-fueled production binge, the fiscally reckless US shale industry now finds itself in a battle for survival. Unlike 2016, this is not a temporary setback – it is a fundamental restructuring of the North American upstream landscape. Highly-levered shale independents who have pursued growth at the cost of free cash flow generation and shareholder value will go the way of dinosaurs and the dodo.

Amid the carnage, keep an eye out for diamonds in the rough: the disciplined, low-cost independents who have kept capex and debt in check and generated consistent returns for shareholders from premium acreage. Identifying and investing in these companies with a long-term horizon will be a lucrative venture as the market swings sharply from bust-to-boom once today’s capex cuts bleed through. We continue to believe that a significant structural supply deficit will emerge and push WTI above $70 in 2022.

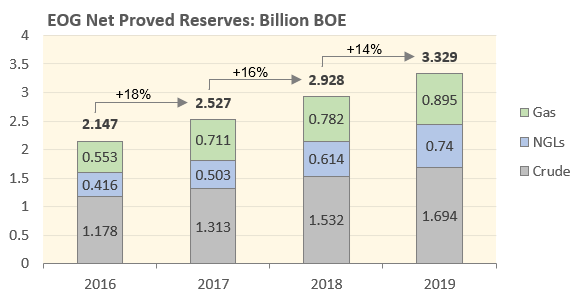

In our view, EOG Resources has positively differentiated itself over the last several years through its ability to consistently generate free cash while simultaneously increasing both production and its reserves base. Net proved reserves have grown by 55% since 2016. This is no small feat considering the well-documented hyperbolic decline profile of shale wells, with production frequently dropping 70% from peak in the first year of production and a further 50% in the second.

Based on a track record of performance and balance sheet strength, we think EOG is a long-term bargain at 1.0x book value and sub-10x P/E and therefore initiate coverage on the Permian-focused producer with a “buy” rating at $40.00.

That said, let’s be clear: 2020 is going to be a difficult year for any oil producer, especially in the US shale patch. EOG is well-run, but it is not immune to exogenous factors. Depressed