. First, there seems to be a need to debunk some persistent myths about gold and precious metal investing. And about hedged investing in general. I will sometimes disagree with the promoters of gold and at other times with the detractors. Some myths originate with world class experts such as Warren Buffett. As well as dime-a-dozen investment gurus. But to disprove them all--you usually need only to do the most basic homework--such as looking at performance charts for the 2008 crash.

First, there seems to be a need to debunk some persistent myths about gold and precious metal investing. And about hedged investing in general. I will sometimes disagree with the promoters of gold and at other times with the detractors. Some myths originate with world class experts such as Warren Buffett. As well as dime-a-dozen investment gurus. But to disprove them all--you usually need only to do the most basic homework--such as looking at performance charts for the 2008 crash.

(Financial charts courtesy of Finance.Yahoo.com and Ycharts. Other images courtesy of Wikipedia.org.)

And now we have an opportunity to recheck our assumptions in a somewhat similar market downturn caused by the Covid-19 virus.

This trail of reason inevitably leads us to question the financial path of modern China. Which--in spite of substantial differences--is still somewhat blindly imitating the template of the United States from the past century. And which is no longer working so well for "US" nor for Europe either.

However--the goal of this article is not simply to understand what is wrong with the world. But to convert understanding into practical ideas to improve the security of investing. These will be found in section B at the end of this article.

A. Ten myth-busting insights about metals and markets.

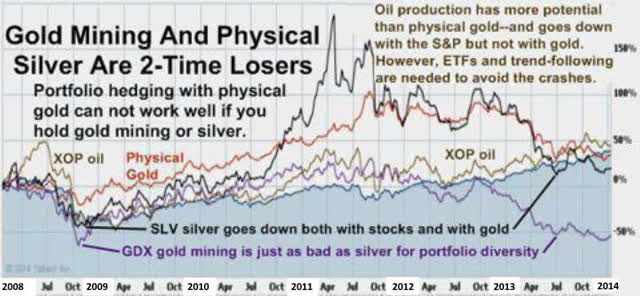

- Gold mining and physical silver are not substitutes or diversifications for gold. They are more like the opposite of gold. During normal times--gold mining (GDX) (GDXJ) and silver ETFs (SLV) may go up when stock indexes go down. However--during a major stock market crash--gold mining and physical silver will abandon this "safety" behavior. They will go down more than stocks. (See performance history chart above.) So why buy them? When gold is always safer and just as easy to buy. Also--the long-term outlook for physical gold prices is excellent because gold