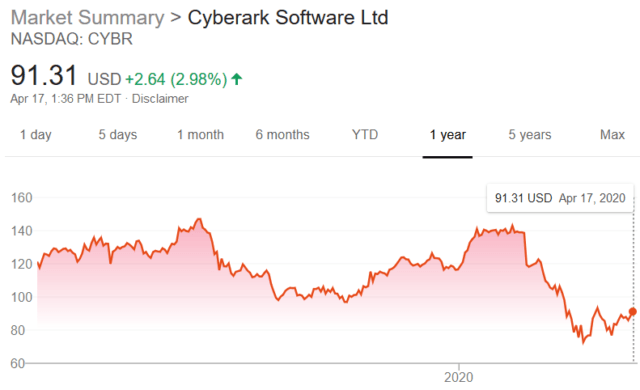

With social distancing and increased adoption of remote work by organizations of all sizes, there is a lot of bullish sentiment on CyberArk Software Ltd. (NASDAQ:CYBR). Through this article, I aim to explain my rationality around the risks to investors from this already pricey stock.

My Stand

To be clear, I am not bearish on CyberArk Software. Privileged Access Management is an important area within cybersecurity and is currently dealt with the seriousness it deserves only by very few organizations. With the growing number of organizations transforming their business digitally, the administrator access for these systems needs enhanced protection.

CyberArk is clearly the leader in the PAM space, and there is large potential in a relatively untapped market.

Competition is growing in the PAM space, but that is a story for another day.

IT Budget Cuts

Recent standards indicate that many firms set aside about ten percent of the total IT budget for cybersecurity. This has been the trend despite security experts arguing against the practice.

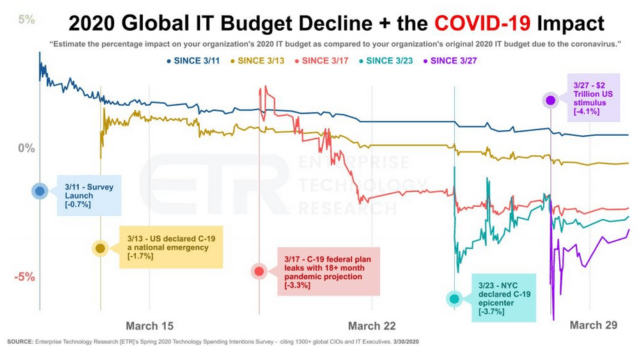

COVID-19 and the associated business disruption are causing organizations to introduce IT budget cuts to increase liquidity and survive during the pandemic.

(Source: Enterprise Technology Research)

There are investments being made by many organizations to enable their staff to work from home. But these are mostly in the lines of equipment and infrastructure:

Laptops and other portable media

Webcams and video conferencing services

Infrastructure to support remote work (Cloud, virtualization services etc.)

Mr. Market is not a subject matter expert in software technologies. As a result, the majority of technology stocks continue to trade at lofty valuations. It is important to understand the difference between what is essential to enable remote work and what is the best practice to sustain remote work in the long term.

Cybersecurity is extremely important for organizations across