(This report was issued to members of Yield Hunting on April 15. All data herein is from that date or earlier.)

Closed-end funds have been hammered. Most entered this crisis at significantly above average levels in terms of valuation. When we talk about valuation, we are referring to the price compared to the net asset value ("NAV"), or the true value of the fund. In other words, the discount or premium at which the fund is trading.

The prices of CEFs have been extremely volatile in the last month. Even worse has been the drop in NAVs. Bonds are supposed to be your defense positions, and even CEFs that incorporate leverage shouldn't be seeing the kinds of declines that they have experienced in the last month. Some areas of the muni market are down 15%.

What's Happening?

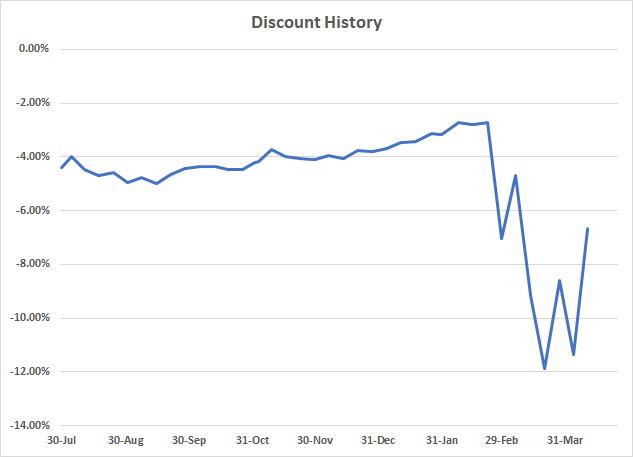

The chart below from RiverNorth shows the valuation change over the last 3 months. It shows just the taxable bond CEF aggregate discounts as of December 31, 2019, and as of April 1, 2020. While we weren't extremely overvalued prior to this crisis, we were on the downside of the bell curve "mountain" and very close to NAV or "par".

Fast-forward 3 months and we were "in the tail" very close to the widest discounts of the last 24 years. The change in the discount means that your price fell by almost 10% more than the NAV. From that perspective alone, the average taxable bond CEF lost almost 10% of its value before even factoring in any drop in the NAV. And of course, NAVs fell significantly. We have since recovered a portion of that loss, as per our weekly discount chart:

Why Did NAVs Fall Significantly?

Volatility over the last month has picked up significantly. And over the last 10 trading days of

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.