Thesis Summary

The ProShares UltraShort S&P 500 ETF (NYSEARCA:SDS) tracks double the inverse performance of the S&P 500. While many investors have waited for a lower low, the market has rallied and is knocking on the doors of 2900. Following technical analysis and fundamental analysis, this could be a great opportunity to invest in SDS i.e., short the market.

ETF Overview

SDS is an inverse ETF that doubles the losses of the S&P 500. In other words, the fund aims to short the market and uses 2x leverage. It does this by using derivatives and swaps and is managed by ProShare Advisors LLC.

Reaching a low around the end of February, the fund has since then exploded as the market doubled, making those invested in the fund a neat +100% return. That is, of course, if you had exited at the right time. Since then, the fund has gone back down to near its prior lows, standing at around $23.

Since we hit the lows on March 20th, many investors have been sitting on the sidelines, waiting for the proverbial shoe to drop. But the market has rallied to everyone's surprise in the face of disappointing virus and economic data.

However, the current 2800 region may offer an opportunity for a short-term short or even a revisit of the lower lows.

Fundamental Analysis

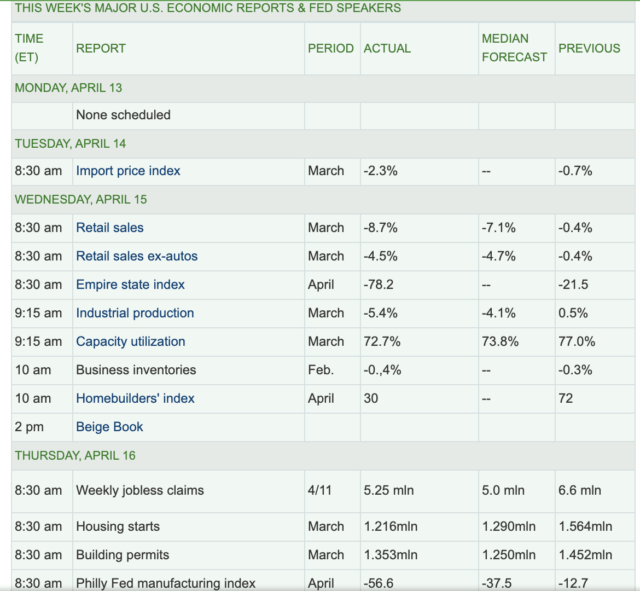

Fundamentally, it is hard to believe that the stock market can continue this surprising rally. Below, we can see some of the most important economic data for the U.S.

Source: Marketwatch

The retail sector has been the hardest hit, but we can see the whole economy showing weakness, and jobless claims have been worse than forecast, at 5.25 million.

Furthermore, this situation is by no means unique to the U.S., with the whole of Europe still ìn lockdown. The Spanish