Author's note: This article was released to our members during market hours on April 22 warning them to sidestep the announcement (or short) the funds in anticipation of a possible cut. After the market closed, NYSE:EDF announced a -53% reduction in distribution, from $0.17 to $0.08 per month, while EDI announced a -47% reduction in distribution, going from $0.1511 to $0.08 per month.

The Stone Harbor Emerging Markets Income Fund and Stone Harbor Emerging Markets Total Income Fund are funds that I've written a number of times on as an illustration of just how inefficient the closed-end fund marketplace can be. Despite being much worse performers than my two picks in the emerging market income sector, the Western Asset Emerging Markets Debt Fund (EMD) and Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD), the Stone Harbor funds continue to trade at elevated premiums due to, you guessed it, their high yields. As of yesterday's close, EDF and EDI yield 29.06% and 26.86%, respectively. [4/23 Update: EDF and EDI's forward yields are 15.53% and 15.71% respectively].

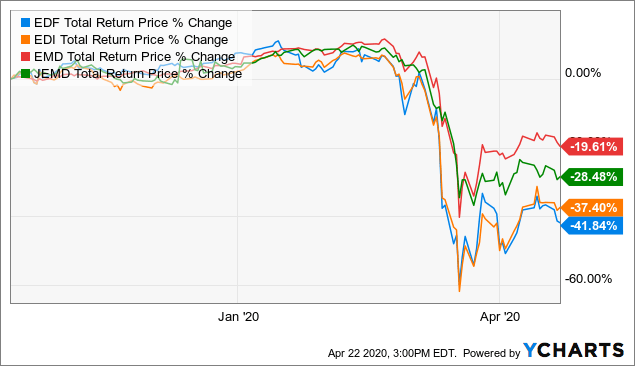

Since we last wrote about the funds on October 15, 2019 (Another Chance To Sidestep EDF And EDI Before Dividend Declaration), EDF and EDI have underperformed EMD and JEMD by an average of around -16% on a price total return basis, i.e. with distributions included. [4/23 Update: with their -10% market price drop upon announcement, the underperformance of EDF/EDI has widened to -23%].

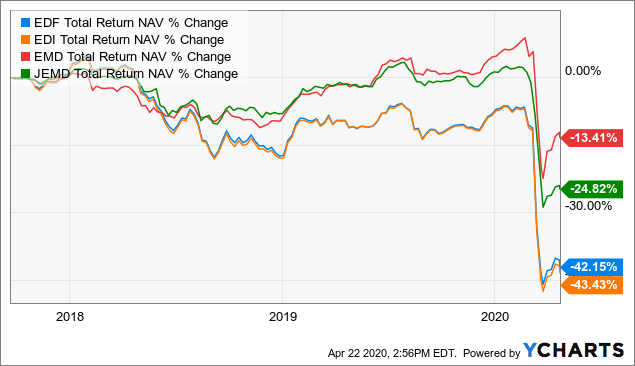

Over the longer term, the performance of the Stone Harbor funds is even worse. Since inception of JEMD around 4.5 years ago, EMD has returned -13.41% and JEMD -24.82% compared to -42.15% for EDF and -43.43% for EDI on a NAV total return basis.

Because they consistently overpay above their earnings, this has led to a rapid erosion of the NAV far

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.