Investment Thesis

CVS Health (NYSE:CVS) stock has been out of favour with the marketplace for some time, but perhaps that is all about to change.

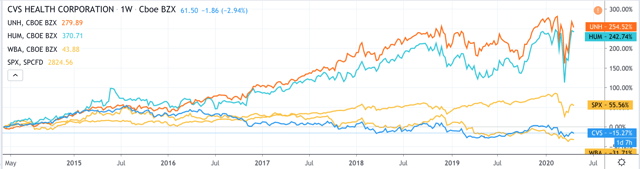

Share price performance of CVS Health vs S&P, healthcare blue chips. Source: TradingView.

Share price performance of CVS Health vs S&P, healthcare blue chips. Source: TradingView.

As we can see from the above chart, over the past five years CVS' stock price has underperformed the S&P 500, losing 15% of its value versus the S&P 500's 55% gain. In 2018, CVS failed to make a net profit despite increasing its overall sales by 5% to $194.5bn, perhaps suggesting that the company's Pharmacy and Retail divisions - responsible for almost of all its sales at the time - needed reinvigorating, and another major complementary source of revenues needed to be found.

CVS's $69bn acquisition of Aetna - America's third largest health insurer - which finally overcame all obstacles and was approved in November 2018, therefore came at just the right time for CVS and has been a catalyst for growth. In 2019 CVS grew revenues by 32% as a result of the Aetna contribution to $257bn, made an adjusted operating profit (calculated by CVS) of $15.3bn, and posted a GAAP EPS of $5.08 per share and PE of ~12.2x.

Although the company's net profit margin in 2019 was just 2.6% CVS's free cash flow from operations amounted to >$12.8bn - up 44% year on year - enough for the company to pay down its near term debt position of ~$4.7bn (and $8bn of debt overall), dividend of $2.0 per annum to shareholders ($2.6bn) and still have sufficient funds to invest back into the company.

At the same time, CVS says that it is realising cost savings and synergies from the Aetna deal faster than forecast and expects to save between $800-900m in 2020, but despite all of this the market has continued