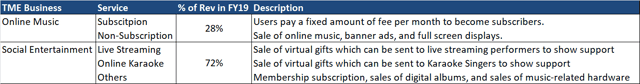

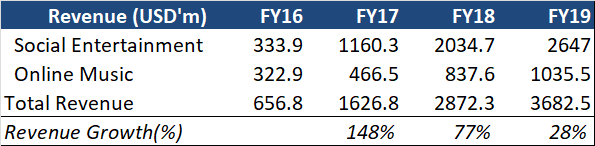

Business Overview

Tencent Music Entertainment Group (NYSE:TME) is China’s largest online music and social entertainment platform in terms of monthly active users (MAU; 4Q19 total MAU: 903m). TME is a leader with twin growth engines. (Online music & social entertainment). TME, found in July 2016 through the merger of China Music Corporation (CMC) and Tencent’s online music business, is China’s largest online music entertainment platform ranked by MAU.

Source: Company Prospectus; Bloomberg

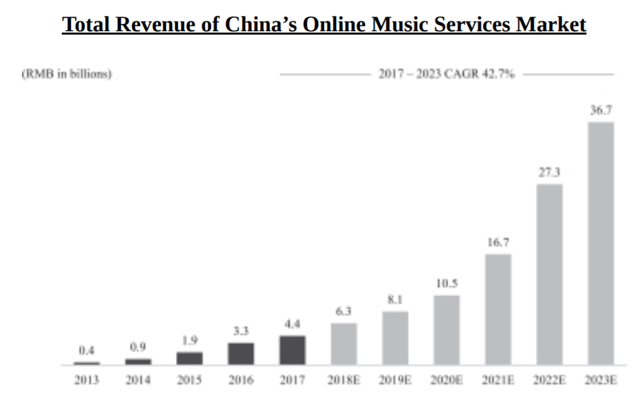

Chinese online music industry with long runway of growth

China’s online music streaming service has one of the highest long-term structural growth potentials as it benefits from rising purchasing power of Chinese middle class.

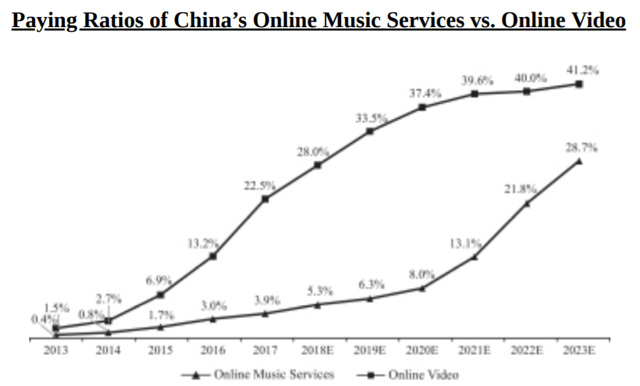

TME’s online music platform has amassed a large user base and is currently under-monetized. According to the prospectus, the paying ratio (number of paying users divided by total number of users) of music subscription in China was only 5.3% in 2018, much lower than 22.5% for online video, 14.1% for online games and 7.5% for online literature, while users’ willingness to pay for music content reached 46.3%. Compared to the US (specifically Spotify), China online music industry’s paying ratio (c.5% in 2018 vs 70% for the US) and average revenue per paying user are much lower reflecting Chinese infant online music industry.

Source: Prospectus

With music entertainment features continuing to improve, and considering the shift from pay-per-download to pay-per-stream, I believe this will spur an increase in online music entertainment payment penetration rate in the long run. Consensus forecasts that the paying ratio could reach c. 20% in the long term when TME widely adopts the pay-per-stream model in China.

TME a dominant leader in the Chinese online music industry

Leveraging Tencent’s considerable user traffic from its WeChat ecosystem, TME achieved collective MAU of 903mn in 4Q19, compared to the 116mn MAU in Sept