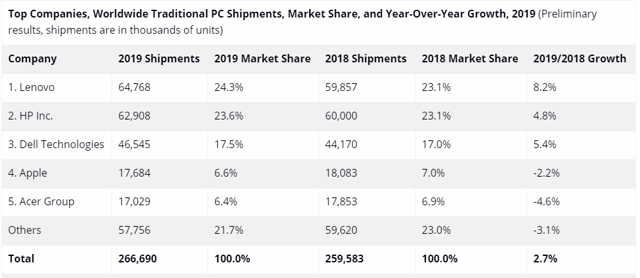

HP Inc. (NYSE:HPQ) shares are down 27% for the year. This is over double the decline of the S&P 500 for the year. This is despite the fact that 2019 marked the first year of growth for the global PC market in seven years. An IDC report notes that global PC shipments grew 2.7% year over year in 2019. Fourth quarter growth was more impressive, coming in at 4.8% year over year. The report does note that, despite these positive results, the near-term future could be challenging since the Windows 10 upgrade cycle boost is now largely behind us. Component shortages and trade negotiations are also mentioned as hurdles to growth, and of course, the impact from the coronavirus was not accounted for at the time of the report. Factors that will help power PC sales growth going forward include new technologies like 5G as well as continued growth in gaming PCs.

Source: HP Store

Investing in a Market Leader

HP Inc. is a leading global provider of personal computing, imaging, printing products, and related devices and services. This is made evident went considering market share. Last year, HP had the second highest market share in PCs, slightly lagging behind Lenovo (OTCPK:LNVGY).

Source: IDC Quarterly Personal Computing Device Tracker, January 13, 2020

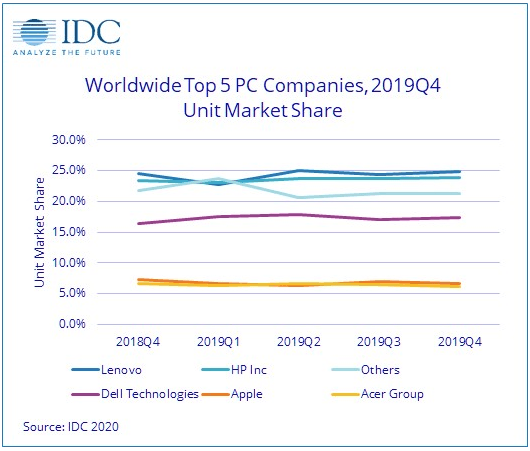

While competition is obviously fierce just like in any profitable industry, HP's market share has remained fairly stable over time per the historical market share graph provided below. The company sells internationally to individual consumers, businesses of all sizes, and to governments.

Source: IDC

Generating Income in the Technology Sector

The recent plunge in the shares brings with it one positive. The company now offers a very attractive dividend yield of 4.7%, with the payout ratio standing at 33.1%. The company also has a solid balance sheet with a very manageable