U.S. Treasury bonds (and bills and notes) are often thought of as risk-free investments.

This is true in a sense; the U.S. Treasury has always fully paid back its debts in dollar-denominated nominal terms. However, what many investors miss is the fact that the purchasing power of those bonds is not guaranteed. They can lose real purchasing power during their holding period, and sometimes rather dramatically.

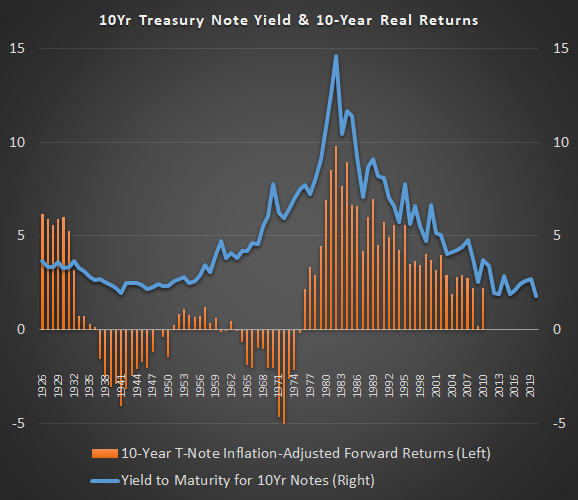

This chart, for example, shows the historical yield of the 10-year Treasury note (blue line) along with the forward 10-year annualized inflation-adjusted return from the start of that year (orange bars):

Data Sources: Robert Shiller, Aswath Damodaran

As you can see, there were long stretches of negative real returns.

In addition, ETFs such as the iShares 20+ year Treasury Bond ETF (TLT) don't hold their bonds to maturity, so they can experience a capital loss on their investment if the bond yield goes up (and thus bond price goes down) during the investor's holding period.

It's important for investors to understand the risks associated with this defensive asset class, and to ensure that they have a risk-management process for their holdings, just like with any other asset class. I like Treasuries as a tactical holding, but it's a position that needs to be managed just like any other.

This article provides a description of three times in the past century that U.S. Treasury bonds lost real value, looks at one similar international example, and then dives into why the current environment is similar to those times.

A Useful Abstraction

In modern times, money is an abstraction that represents purchasing power, but is not valuable in and of itself. We don't walk around with silver coins in our pockets, paying each other like pirates.

Instead of being made of a rare and valuable substance, modern money

I share model portfolios and exclusive analysis on Stock Waves. Members receive exclusive ideas, technical charts, and commentary from four analysts. The goal is to find opportunities where the fundamentals are solid and the technicals suggest a timing signal. We're looking for the best of both worlds, high-probability investing where fundamentals and technicals align, and we identified a ton of bearish setups in the past couple months leading up to this crash in our "Where Fundamentals Meet Technicals" series.

Start a free trial here.