The share prices of ethanol producers have staged an impressive recovery over the last three weeks.

While companies such as The Andersons (NASDAQ:ANDE), Green Plains, Inc. (NASDAQ:GPRE), Pacific Ethanol (PEIX), and REX American Resources (NYSE:REX) have all been lifted by the market, the share prices of REX American Resources and Green Plains in particular have handily outperformed the broader S&P 500 index (see figure) over the period. The extreme bearish sentiment that prevailed at the beginning of April has disappeared and producers' share prices are quickly approaching their pre-coronavirus levels.

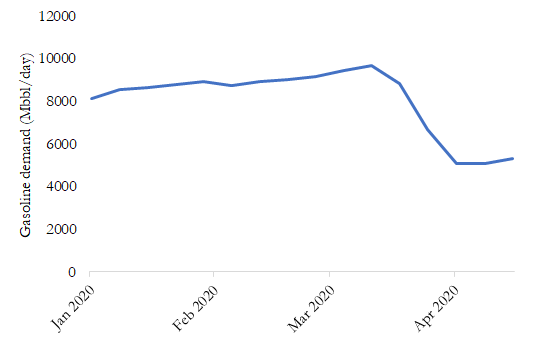

The ethanol sector has not been alone in this regard, of course: The merchant refining sector, which produces the gasoline that ethanol competes with for market share, has also seen its share prices shoot higher since late March. In both cases, the rallies have been driven by a growing expectation in the market that gasoline and ethanol demand are experiencing a V-shaped recovery following March's severe demand disruption to both fuels. This expectation has been supported by the fact that gasoline demand has increased during the last three consecutive weeks even as social distancing measures have remained in place across most of the U.S. (see figure). The refining sector has further benefited from the collapse of near-month crude prices that enabled at least one of them to take advantage of negative feedstock costs.

Source: EIA (2020)

Ethanol demand has fallen alongside gasoline demand in response to the COVID-19 pandemic. Ethanol stocks were already near all-time highs due to recent overproduction even before social distancing measures went into place, though, and the severe demand disruption has affected ethanol producers even more strongly than it has refiners as a result. Whereas U.S. gasoline production has modestly rebounded alongside gasoline demand, ethanol production has continued to decline in recent weeks (see figure). Weekly production for the period ending April 24 was