Introduction

Qualcomm (NASDAQ:QCOM) exceeded its revenue target and profit estimates for the second quarter. With this, the tech company has delivered convincing figures, just like Alphabet (GOOGL) and Microsoft (MSFT) before and has shown that COVID-19 does not necessarily lead to the end of the world. Let's take a closer look at the numbers.

The second-quarter numbers have shown some light at the end of the COVID-19 tunnel

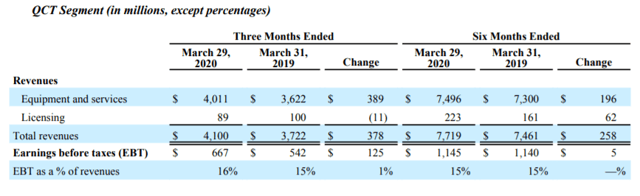

QCT Segment

The QCT segment that includes Qualcomm's broad portfolio of CDMA- and OFDMA-based technologies, including wireless devices and infrastructure integrated circuits, saw growth on a three-month as well as on a six-month basis. Only a little but not an important licensing business saw a small decline in the second quarter.

(Source: Latest filing)

QTL

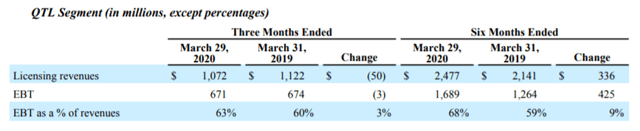

Much more important is the licensing business in the QTL segment (do not confuse both). According to the company, QTL:

grants licenses or rights to use portions of our intellectual property portfolio that are essential to the manufacture and sale of certain wireless products. Providing access to our leading intellectual property portfolio for wireless technology has been a catalyst for industry growth".

The QTL business shrank by USD 50 million in the second quarter but met the midpoint of the company's guidance.

(Source: Latest filing)

The main reason for the decline in revenue was COVID-19 (what else?). I do not see the substance of the business threatened, however. You can see from the earnings call that demand in China increased sharply again at the end of the second quarter, which is excellent news.

First, pronounced weakness in China in late January and February, followed by a substantial recovery exiting the quarter. And second a decline in demand in many other regions globally starting in March. This negative impact on QTL was partially offset by a benefit related to updates to previous