Overview

Brightcove (BCOV) presents a good, long-term investment opportunity given the exposure to the rising trends in video content marketing. In a nutshell, the company builds a cloud video publishing and distributing system built for media companies and enterprises. The company has competitive products, having consistently been investing in R&D to increase the breadth and depth of its video platform. Revenue has tripled over the last eight years, though growth has slowed down and dropped to high single digits in recent times.

However, towards the end of 2019, things seemed to turn in Brightcove's favor as it posted its first double-digit annual revenue growth in over four years. In light of the solid Q1 2020 results, we continue to believe that the stock will benefit from the growing trends of video consumption and also the investments in its products in the long run.

Catalyst

As the demand for video content across various platforms such as OTT, online, and mobile devices continue to rise, media companies and various brands/enterprises are looking to produce more video content to capitalize on the opportunity. Brightcove has made some strategic moves to respond to these needs in recent times. The company acquired its long-term competitor Ooyala in early 2019. Furthermore, it launched Brightcove Beacon and Campaign towards the end of 2019 and early 2020. In March 2020, CEO Jeff Ray also purchased additional 10,000 shares to increase his ownership to 95,000 shares in the company, which was a signal that good things might start to happen soon.

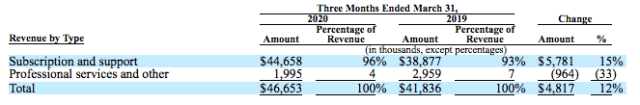

(Source: Company's 10-K)

In Q1 2020, we indeed began to see encouraging results as the company grew its revenue by 11.7% YoY to $46.7 million. Much of that was due to the 15% increase in the subscription and support revenue, whose share of the overall revenue also expanded by 300 bps YoY to 96%. The