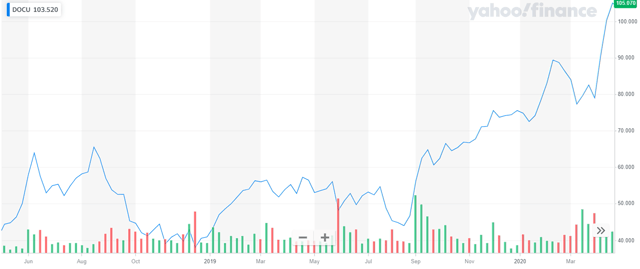

Enterprise software companies seem to have been spared from the brunt of the COVID-19 pandemic. DocuSign (NASDAQ:DOCU), a leading player in the electronic signature space, is fast emerging as a major winner in 2020. This SAAS (software-as-a-service) stock is already up 39.68% YTD (year-to-date). While valuations seem stretched at this point, DocuSign is definitely a fundamentally strong story for 2020.

DocuSign is not a pure-play in the healthcare space. However, the company is now increasingly focusing on increasing its exposure to the healthcare segment. Founded in 2003, DocuSign is a pioneer in the e-signature space and has made major strides in the financial services industry. The company went public in April 2018. Since 2012, the company has been making steady progress in ramping up the adoption of its e-signature business.

DocuSign is one of the few coronavirus-resilient stocks in the market. While the company is not profitable yet, Wall Street expects the company’s EPS to rise YoY by 62.70% in 2020 and 72.75% in 2021. Analysts expect the company’s EPS to grow at a CAGR of 25.30% in the next five years. Despite all this, the forward PE (price-to-earnings) multiple of 122.80x and PS (price-to-sales) multiple of 19.39x is pretty expensive. The COVID-19 pandemic is bound to affect the spending capability of IT companies, which is DocuSign’s core client base. This, in turn, can present short-term headwinds for the company. However, this can also open up some attractive entry opportunities for investors. I believe retail investors should be on a lookout of any pullback to pick up this stock.

DocuSign’s e-signature platform is a key growth driver for the company

The COVID-19 pandemic has forced companies, big and small, to transition to the remote working environment. However, this switch was unanticipated and most of the companies are not yet well-equipped to handle the virtual