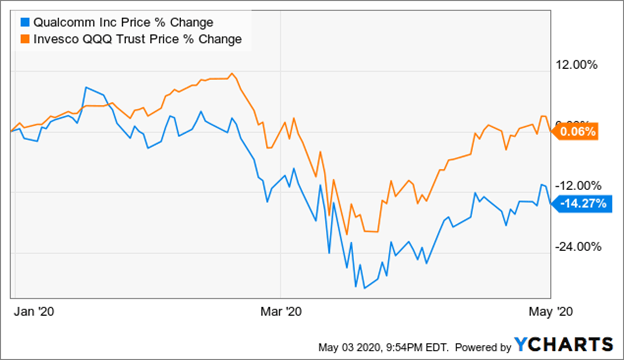

Qualcomm Inc. (NASDAQ:QCOM) stock has been hit hard by the coronavirus pandemic. The stock is down 14% YTD, versus the Nasdaq 100 Index that's flat for the year. Since I don't expect QCOM will be affected by the pandemic or the upcoming recession more than the average company, and considering that they still have potential for growth in the long term, I believe this is a great opportunity to buy the company at a discount.

Earnings Highlights

Last week, Qualcomm announced their FY 2020 Q2 results. QCT, their semiconductor segment, reported revenues of $4.1B (+10% YoY) and EBT of $667M (+23%), but had a decrease in the number of MSM units sold (129M, -17%). Meanwhile their licensing business, QTL, reported revenues of $1.07B (-4% YoY) and EBT of $671M.

According to management, their results were negatively affected by a 21% YoY reduction in the demand for 3G/4G/5G handsets, due to the coronavirus pandemic. However, the pandemic also highlighted the importance of broadband in facilitating remote work, entertainment, education, telemedicine, and others.

For their QTL segments, the company reported they have now 85 5G license agreements, up 5 from last quarter. Of note are their long-term deals with OPPO and Vivo to cover 5G multi-mode mobile devices. They are still in discussions with Huawei, and the result of these discussions will surely have an impact on QCOM's stock price.

Many semiconductor companies reported steady demand in Q1/Q2 due to inventory accumulation from OEM's in case of a future disruption of supply chains. One analyst asked if this was the case too with Qualcomm, and the answer was very positive:

Well, I mean, we obviously spend a lot of time looking at the sell-in of chipsets versus the device sales and matching them and getting a sense of how the inventory profile is shaping