ETF Overview

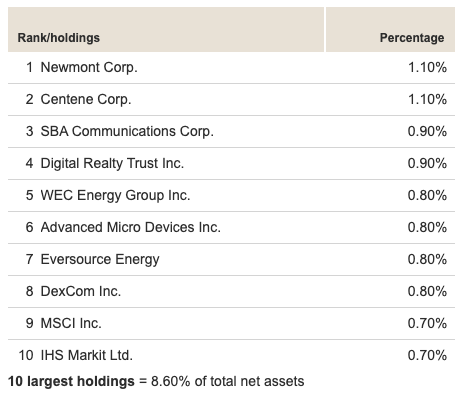

Vanguard Mid-Cap ETF (NYSEARCA:VO) owns a portfolio of mid-cap U.S. stocks. The fund seeks to tracks the result of the CRSP U.S. Mid-Cap Index. The fund has little concentration risk as its top-10 holdings only represent about 8.6% of its total portfolio. It also has better growth profile than its small-cap peer. However, its growth profile is slightly inferior than its large-cap peer. Given the fact that large-cap stocks tend to have better balance sheet and competitive positions than mid-cap stocks (we are going through a rough period of uncertainty caused by COVID-19), it may be a less risky option to invest in funds that own large-cap stocks.

Fund Analysis

A diversified portfolio of mid-cap stocks

VO tracks the CRSP U.S. Mid-Cap Index. This index selects U.S. stocks that fall between the top 70% - 85% of investable market capitalization. The index applies a market-cap weighted approach to determine the weighting of each stock in the index. This strategy results in a portfolio of about 340 stocks. VO rebalances its portfolio once every quarter. The index’s market-cap weighted approach helps it to reduce its turnover rate. In fact, its turnover rate was only about 15% in the past year. This also helps Vanguard to keep its expense ratio low (only about 0.04%). Since VO targets mid-cap stocks, concentration risk is low. As can be seen from the table below, its top-10 holdings only represent about 8.6% of its total portfolio. Its top holding Newmont (NEM) only represent about 1.1% of the total portfolio. Therefore, a weak performance of any single stock will have limited impact on VO’s portfolio.

Source: Vanguard Website

VO has good growth profile and better financial health than its small-cap peer

Mid-Cap stocks such as stocks in VO’s portfolio are usually companies that have established