The Weather

Last week

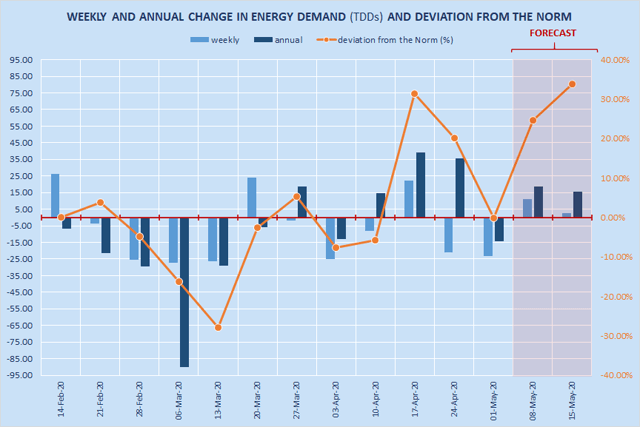

Last week (ending May 1), the number of heating degree days (HDDs) dropped by 35% w-o-w (from 75 to 49), while the number of cooling degree days (CDDs) increased by 17% (from 17 to 20). However, we estimate that total energy demand (as measured in total degree days, or TDDs) was 17% below last year's level, but mostly in line with the 30-year average for this time of the year.

This week

This week (ending May 8), the weather is cooling down, but only slightly. We estimate that the number of nationwide HDDs will edge up by 1.6% w-o-w, while the number of cooling degree-days (CDDs) will jump by more than 50% w-o-w (from 20 to 30). Total average daily consumption of natural gas (in contiguous United States) should be somewhere between 82 bcf/d and 86 bcf/d, some 3.9 bcf/d higher than in the same week last year. Total energy demand (measured in TDDs) should be some 25% above the norm and as much as 31% above last year's level.

Next week

Next week (ending May 15), the weather conditions are expected to get significantly colder. The number of HDDs is currently projected to jump by 21% w-o-w (from 49 to 60), while the number of CDDs should drop by 26% w-o-w (from 30 to 22). Total energy demand (measured in TDDs) should rise by 24% y-o-y, while the deviation from the norm will increase to +34% (see the chart below).

Source: Bluegold Research estimates and calculations

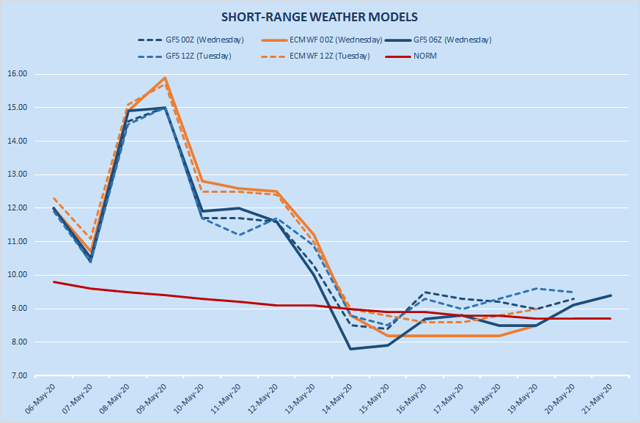

The latest numerical weather prediction models (Wednesday's short-range 00z runs) agree that, over the next 15 days, TDDs should remain above the norm (on average) - see the chart below.

Source: NOAA, ECMWF, Bluegold Research

However, projected TDDs are trending down and there is a minor disagreement between the models

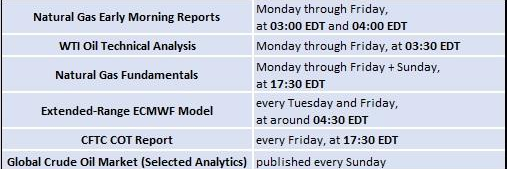

Thank you for reading this article. We also write daily and weekly reports, covering key variables in U.S. natural gas market (supply, demand, storage, prices and more). We provide the following to subscribers:

We are offering a two-week free trial, and we will soon begin to cover global LNG market. Come and join us.