It is a shame that Criteo (NASDAQ:CRTO) does not garner more attention around these parts. The stock was deeply undervalued pre-COVID, but post-COVID, valuations have moved to near-ludicrous levels, in my view. For CRTO to work, I do not think investors need to adopt a view on a potential turnaround - the company is well-capitalized and cash-generative, yet the equity value lingers far below its tangible assets and replacement value.

At current valuations, the market appears to be either expressing an extremely bearish view on the company as a going concern or assigning zero credit to Criteo's balance sheet value (likely the latter). At ~1.6x FY20 EBITDA, the market seems content to ignore CRTO's depressed multiples, but with cash flow generation set to continue (even in a bear case scenario) and accumulate on an increasingly net-cash balance sheet, I think patient investors stand to be well-rewarded.

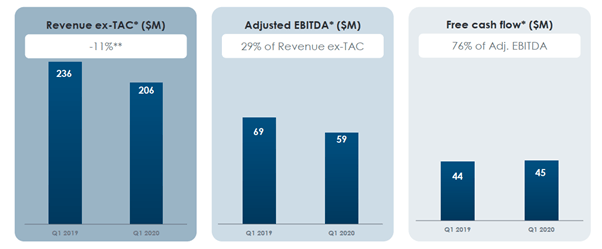

1Q20 Revenue Declines Led by Weakness in Travel

The headline numbers for the quarter did not make for pretty viewing - revenue ex-TAC was down 13% YoY (-11% YoY on a constant currency basis) to $206mn, while adjusted EBITDA came above consensus in at $59m (-14.5% YoY). Free cash flow remained strong at $45m for the quarter. Criteo ended the quarter with 20,360 total clients (+5% YoY).

Source: Investor Presentation

Given Criteo's exposure to the travel segment (~10% of revenue) and the Asia Pacific region, Criteo has felt the impact of COVID-19 earlier than peers such as Snapchat (SNAP). The latter noted strong January and February trends with end-March cited as a key period of weakness, while Criteo noted weakness as soon as the last guidance update in February.

For 1Q20, the COVID-19 impact on revenue ex-TAC for APAC, EMEA, and the Americas stood at $2m, $5m, and $3m, respectively. Same client revenue declined by 9% YoY (-4% YoY ex-COIVD), with client spend in travel and classifieds