As I mentioned in my last article on BRF SA, I would be updating my valuation on the company to reflect the new information from their first-quarter results. I also participated in their 1Q20 conference call to get a better understanding of the company's strategy to improve its profitability. Reading a company's strategy tends to generate more questions than it answers since it usually is less detailed and very bland. Listening to them talk about allowed me to understand the details of the strategy.

Quick risk overview, BRF SA was involved in several political corruption scandals. The economic effects of these scandals have already been accounted for during the past couple of years. Though the accounting effects have been taken into consideration, the negative impact on their brands continues. The company's brands (both international and domestic) suffered from these scandals as it was a very public ordeal.

Overview Of 1Q20 Results

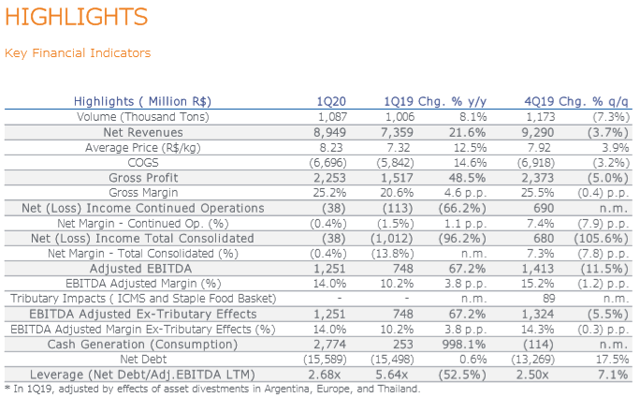

The company's 1Q20 results were better than my estimates on the top line but less than my estimates on the bottom line. The company's total net sales exceeded my expectation by about 3% (+R$ 238 million). This was a result of a higher increase in Net Sales in the international market (not in volume) than I had estimated. The company's bottom line was lower than my estimates (-R$248 million), for two reasons. First, the company took a write-down of 81 million reais where 24 million was for expected losses in accounts receivable, and 14 million was an asset retirement expenses. According to the CEO, these provisions of 38 million were a direct result of COVID-19. Lastly, the effect of the exchange rate on their financial expenses was a lot higher than my original estimates. The net interest expense issue has been addressed in my model.

Source: 1Q20 Management Report

Source: 1Q20 Management Report