Western Midstream (NYSE: NYSE:WES) is a more than $3 billion midstream company with a dividend yield of almost 20%. The company’s share price has more than doubled from its 52-week lows of less than $3 / share supported by both the MLP crash and investor fears that Occidental Petroleum (NYSE: OXY) would try to sell its stake to raise cash. However, despite the uncertainty, Western Midstream’s impressive assets and financial potential will support long-term returns.

Western Midstream - Earnings Slides

Western Midstream COVID-19 Response

Western Midstream has responded heavily to COVID-19 and the potential threats to the company’s business.

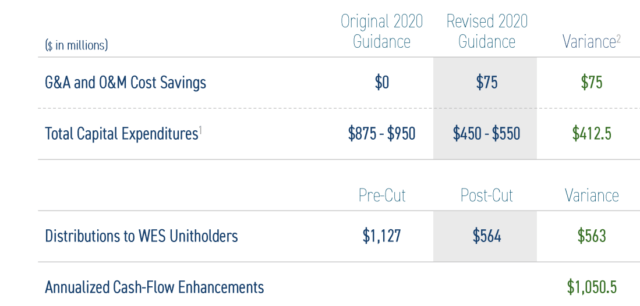

Western Midstream New 2020 Guidance - Western Midstream Investor Presentation

Western Midstream has made three significant decisions to improve its cash flow resulting in annualized cash flow enhancements of more than $1 billion annually. The company has accomplished G&A and O&M cost savings of $75 million on an annualized basis and has managed to reduce its capital expenditures by $500 million. That’s incredibly significant.

Before we discussed how Western Midstream was in a great position but needed to spend within its cash flow to move forward. The company also chose to cut distributions to WES unitholders by a 50% cut. It’s worth noting that the company’s yield post cut will still be the near 20% yield we discussed above. However, that alone saves the company more than $500 million annually.

Overall, Western Midstream’s financial strength puts it in a good position going forward.

Western Midstream 1Q 2020 Results

At the same time, in a difficult quarter, Western Midstream had incredibly strong 1Q 2020 results.

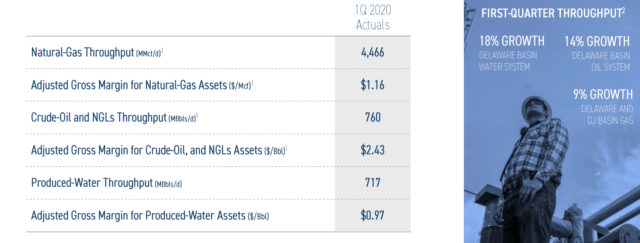

Western Midstream 1Q 2020 Throughput - Western Midstream Investor Presentation

Western Midstream has throughput of more than 4.4 billion cubic feet / day, with significant growth across its major business and adjusted gross margin of $1.16 / million cubic feet. The company also had

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.