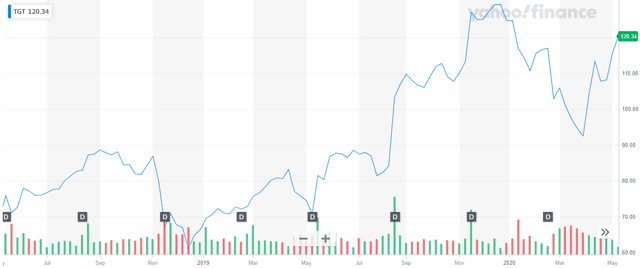

Mega-retailer, Target (NYSE:TGT) is fast emerging as one of the success stories during the COVID-19 pandemic. The company’s shares had crashed from $125.36 on January 2 to $91.04 on March 25 along with the broader market. While the stock recovered much of its losses in April, it again fell to $103.86 on April 23 after the retail giant's first quarter update disappointed investors. The stock closed at $119.39 on May 12, which implies a YTD (year-to-date) performance of -6.88%.

Pandemic or not, people need food and other essentials. And in times of the pandemic, social distancing norms have shifted much of the purchasing activity to online platforms. Target seems well-equipped to ride this trend. Increased focus of investors on consumer staple stocks during a recessionary environment coupled with changing consumer behaviour has made Target an attractive coronavirus-resilient pick for May 2020.

Target’s omnichannel retail experience is being preferred by customers

PCE (Personal Consumption Expenditure) is closely linked with the performance of consumer staple stocks. In times when PCE is down, consumer staple stocks tend to relatively outperform the market. With PCE down by 7.5% in March 2020, it was but obvious that investors would start looking at these customer stocks as safe havens. Target has definitely been one of the key beneficiaries of this trend.

However, going beyond that, the company is also benefitting from its digital and in-store innovations. In times when social distancing norms are making people more prone to avoid store visits, the company’s solid technology base is helping to keep the wheel moving.

On April 23, Target highlighted a 7% quarter-to-date rise in same-store sales, with a more than 100% surge in online sales. The company’s month-to-date digital same-store sales in April saw an even bigger spike of 275%. These numbers hint at a more protracted recovery of demand at malls