We went long on Sogou (SOGO) because Tencent (OTCPK:TCEHY) owns 70% of it. This is the same reason why we made a bet on Tencent Music Entertainment Group (NYSE:TME). Tencent still owns more than 62% of TME. We are prudent investors. Having a powerful and cash-rich parent company assured us that Tencent Music has long-term longevity. Tencent's hoard of $28.21 billion in cash and short-term investments can boost Tencent Music. Tencent's recent purchase of a 10% stake in Universal Music Group was obviously for the benefit of TME.

(Source: Tencent Music Entertainment)

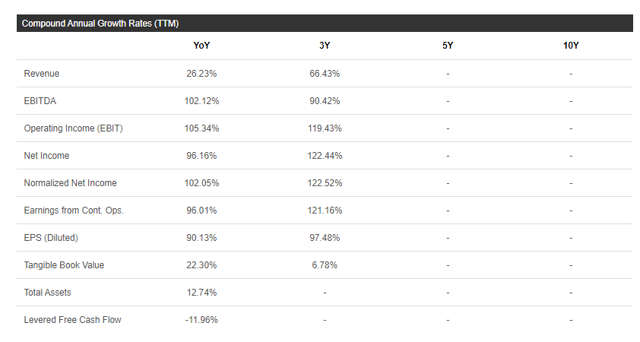

Tencent Music is a high-growth investment. Tencent Music touts a 3-year revenue CAGR of 66.43%. Its 3-year normalized net income CAGR is also 122.52%. A fast-growing company that is also very profitable is a solid gold buy-and-hold-forever stock. TME is our bet on China's growing $53 billion/year music industry.

(Source: Seeking Alpha)

TME is currently trading below its December 12, 2018, IPO day's closing price of $14.19. This is an aberration. Paid music streaming is a pandemic-boosted industry. Goldman Sachs analysts already identified Tencent Music as the new no. 3 in music streaming by 2030. The low monthly subscription fees of TME will eventually help it outpace the growth of Apple Music (AAPL).

(Source: Seeking Alpha)

TME is no. 1 in China, with a 70% market share. China is still unable to solve its COVID-19 dilemma. Expect more Chinese to stay at home, work-from-home, and learn from home. Most Chinese citizens will eventually try paid music and video streaming services. They need to because it can ease the tedious existence of quarantine living. Listening to our favorite music contributes a lot to our mental fitness. Quarantine rules are bad for mental health.

As of last year, Tencent Music is only ranked no. 4 in terms of market share