Nitesh Rao assisted the author with research (Rao will soon receive his MBA and Master of RE Dual-Degree Candidate from Cornell S. C. Johnson Graduate School of Business... congratulations Nitesh!).

We’re certainly living in interesting times these days. There’s no way around that fact.

Due to the unprecedented response to the current pandemic, we’re having to look extra hard and extra careful to find worthwhile buys.

That’s why we were so happy to hear Realty Income CEO Sumit Roy tell us in a recent iREIT on Alpha interview that the company’s “dividend is sacrosanct to who we are.”

With a track record of paying and increasing dividends for more than 27 years in a row, it’s clear that “the monthly dividend company” treats dividend growth as the “holy grail,” with it as the Knights Templar watching over it.

That hasn’t stopped the “big O” from being hammered due to coronavirus though, down about 35% at last count. Investor sentiment seems to be weighing heavily on its exposure to the hardest-hit net lease sub sectors, such as theaters, gyms, and restaurants.

We get that. Fortunately, there’s more clarity coming.

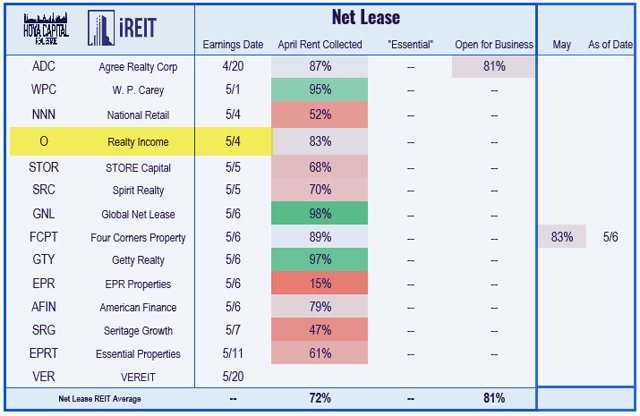

For one thing, Realty Income recently reported that it collected about 83% of its May rent due – which is somewhat better than we expected. And, on the recent earnings call, Roy said it “received essentially all expected rent from investment grade-rated tenants.”

Source: iREIT on Alpha

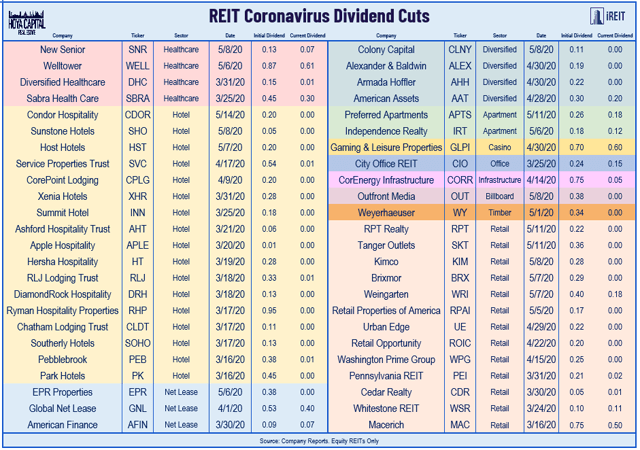

Of course, the coronavirus pandemic has challenged a number of REITs. At last count, there were 48 equity REITs that have either cut or suspended their dividends. Much of this has been in the lodging and retail sectors, with only three net lease examples to be found.

Source: iREIT on Alpha

Within the retail sector meanwhile, four mall REITs have succumbed to dividend halts:

- Macerich

A Preferred Path To Safe Income During Turbulent Times

Today we are formally announcing the all-new iREIT Preferred REIT Tracker in which we provide data on 100% of REIT preferreds and all of the exchange-listed "baby bonds." The average REIT preferred stock can be bought for an average 20% discount to their par value, which is typically $25.00, and currently provide an average dividend yield of roughly 7% (excludes hotels and malls).

The FASTEST GROWING REIT Service on Seeking Alpha!