There's always something to do at InterActiveCorp (NASDAQ:IAC), and with the upcoming Match spin set to leave Barry Diller with a sizable cash position and a clean balance sheet to boot, IAC certainly warrants investor attention. By owning IAC stock, shareholders get to invest with Diller in a post-COVID environment that should surface plenty of value-accretive opportunities. On the other hand, IAC pre-Match Group (MTCH) spin also presents a compelling play on the IAC "stub," which currently trades at negative valuations. The pending MTCH spin should unlock some of that value, in my view.

Cautious Optimism After a Below-Consensus 1Q20

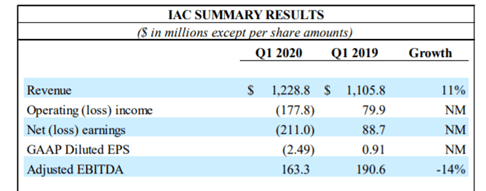

IAC's 1Q20 ex-Angi Homeservices (ANGI) and MTCH EBITDA losses widened to a below-consensus -$43m off above-consensus revenue of $341m. On a consolidated basis, revenue stood at $1.2bn (+11% YoY), while adjusted EBITDA declined 14% YoY to $ 163m. Here's a snapshot of the headline numbers:

Source: Earnings Release

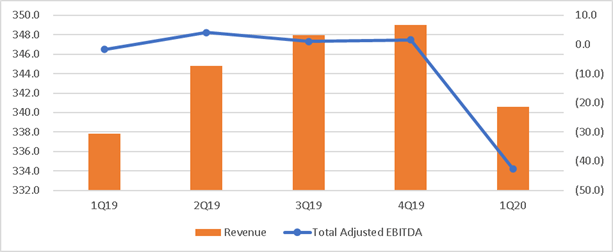

And here's an overview of how the "stub" (i.e., IAC ex-MTCH/ANGI) has trended in recent quarters:

Source: Company Filings

No surprise that April is set to worsen relative to 1Q numbers, but I did draw some comfort from management's cautiously optimistic tone, as several businesses are showing signs of recovery off COVID-driven lows.

ANGI has seen metrics decline in the back half of March and the beginning of April, but per management, demand has returned over the past few weeks, likely due to shifting spend to Home projects (vs. Travel, Social, etc.) on the shelter-at-home tailwind and improving weather, among others. Specifically, April revenue is down 2% YoY.

Vimeo is seeing even more impressive traction, as subs, bookings, & revenue have all begun to accelerate in April (e.g., revenue is up 38% YoY), as the longer-term streaming opportunity at small businesses and Enterprise remains intact.

Similarly, Dotdash's revenue has risen at a +22% pace in