This is the third in a series of articles covering quality stocks that serve as a foundation for rebuilding a portfolio. The first installment of this series covered UFP Industries (UFPI), and the second covered Simpson Manufacturing (SSD).

The world has changed since the last time I wrote about Texas Pacific Land Trust (NYSE:TPL) eight months ago. At that time I was looking forward to new pipelines providing an outlet for pent up production in the Permian. Higher production was expected to provide more revenue for the Trust. The Trust was also in the middle of a very ugly proxy battle.

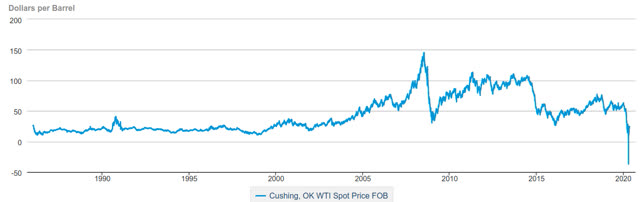

Since then, a pair of black swans have caused a crash in oil prices. The first was the pandemic that stopped people from commuting and travelling. The second was an oil price war between Saudi Arabia and Russia. The Trust remarked on these in a rare statement of current affairs:

Oil demand has significantly deteriorated as a result of the virus outbreak and corresponding preventative measures taken around the world to mitigate the spread of the virus...Although certain OPEC+ nations have reached a tentative agreement on production cuts since such time, there is an excess supply of oil on the market and constraints on storage capacity. The convergence of these events is expected to result in the downward pressure on certain commodity prices continuing for the foreseeable future.

Here is one picture of oil prices that tells the tale more explicitly:

Source: EIA.gov

At one point the price of oil actually went negative. It was at $24.02 when I started writing this article, and has since improved to $31.83 over the week. While the Trust does not itself drill for oil and gas, its revenue stream is tied to oil prices.

The Business

The Texas Pacific Land Trust is