Ninety percent of all millionaires become so through owning real estate.

- Andrew Carnegie

There are a lot of theories going around the housing market. Some analysts are bullish, some bearish, and some neutral. So, I figured it would be a productive exercise to analyze the residential housing market by correlating recent data published by different sources such as NAHB, NAR, and the Census Bureau.

The data published in May 2020 is negative but the news is not all bad. It is almost on the lines that I had anticipated in early-May 2020 when I had reported in The Lead-Lag Report that low 30-year mortgage rates would spur activity in the housing sector. That said, the COVID-19 situation is evolving and we don’t know what will happen in the next 60 days as states begin to reopen in the middle of the pandemic. Therefore, all my predictions here are valid for the near term.

Image Source: Twitter

Back to the housing data now – yes, the numbers are negative but not as bad as the analysts had estimated. Let’s dig in deeper.

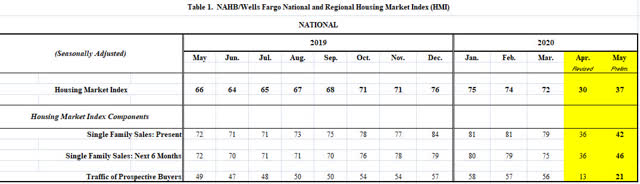

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI)

Image Source: NAHB

The NAHB/Wells Fargo HMI represents three indices – It is a weighted average of the Present Single-Family Sales Index, the Single-Family Sales for the Next 6 Months Index, and the Traffic of Prospective Buyers Index. The HMI has recovered to 37 in May 2020 after crashing to a low of 30 in April.

But the road ahead isn’t smooth because the HMI was at 72 in March 2020 and it will take some time for it to reclaim that slot. Also, HMI above 50 is considered a positive sign, so the present data are still in bear territory.

The uptick also could be

Subscribers warned to go risk-off Jan. 27. Now what?

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.