Alteryx, Inc. (AYX) is a market leader in analytics, data science, and process automation, three pillars of digital transformation that are seeing signs of maturation and bumping elbows as vendors start to expand into adjacent niches.

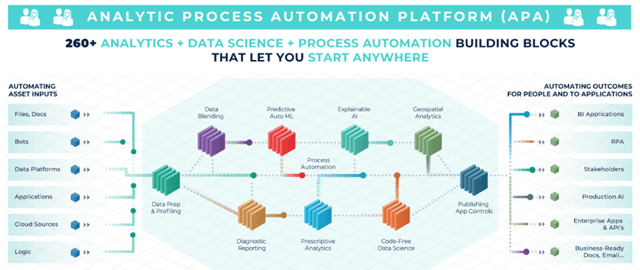

Alteryx has a vision of being the front-runner of a market category that it calls Analytic Process Automation (APA).

(Source: Alteryx)

I'm not sure whether Alteryx has created a new market platform or this is simply a marketing ploy. From what I have been able to tell, this announcement has not spawned any revolutionary technology but simply expresses where the company is in terms of product offering.

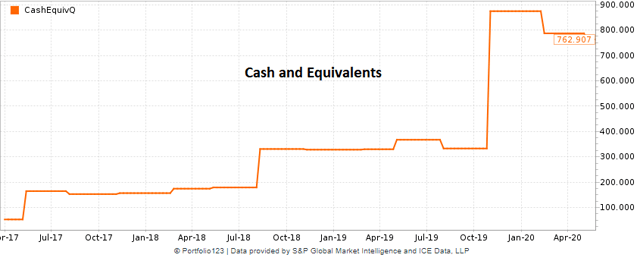

But in any case, I am impressed with Alteryx's strong revenue growth of 60+% that it has maintained over the years. Between the revenue growth, positive cash flow, and $760 million in cash and equivalents, Alteryx should survive the pandemic and recession quite nicely.

(Source: Portfolio123)

I should note that Alteryx management has withdrawn guidance for FY 2020 and provided very conservative guidance for the next quarter with YoY revenue growth of 10%-15%. I am not going to read too much into the low level of guidance as management got burned on Q1 earnings with a miss on analysts' estimates, something that is not well-tolerated by investors in SaaS companies.

It is impossible to predict how Alteryx will perform for the remainder of 2020, but the company has a strong balance sheet, steady free cash flow, and exceptional revenue growth prior to the pandemic. Alteryx should be in good shape once the pandemic scare subsides and global growth restarts. Given the stock's reasonable valuation, I am maintaining my very bullish rating for Alteryx. This company is one of my favorites.

The Rule Of 40

One industry metric that is often used for software companies is the Rule