We feel bullish about Ingredion Inc. (NYSE:INGR). Even before COVID-19, the company was going through a tough macro environment and other troubles beyond their control. Shares have been beaten down from a high of $140 in the early months of 2018 to a recent $84.23, after rebounding somewhat from the market sell-off in March. However, weakness in their share price was not an irrational move by the market. During 2018 and 2019, management had to reduce their earnings guidance, starting in the first quarter of 2018 followed by more cuts as the company was facing tough headwinds.

Our bullishness comes from the higher probabilities of margin expansion and returns on capital once their specialty ingredients segment takes a larger percentage of revenues. Ingredion operates in a commodity market, but growth in its specialty segment gives them better pricing power, as the process requires more specialization. It also gives them some competitive advantages in the way of switching costs.

COVID-19 is going to impact the business in the short run, as their products are used in the foodservice and brewing industries. Both affected by shelter-in-place orders. However, we don’t see COVID-19 impacting their fundamentals in the long-term. Ingredion’s products are used in key consumer markets such as food, beverage, brewing, paper, and animal nutrition. Also, the company was already implementing a new cost program and was shifting its capacity to increase production for its specialty segment while focusing less on producing secularly declining products like high fructose corn syrup. In a way, they were already adjusting to new trends within their industry.

Ingredion should provide some decent returns to long-term investors. We have a fair value estimate for Ingredion of $112.

Looking at their numbers

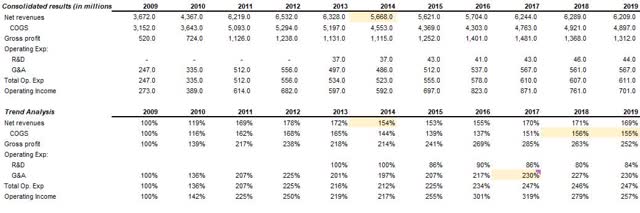

Ingredion’s operating results show a stable company, even though their products are mostly commodities, which