Over the past few months, we have witnessed the price of the VelocityShares 3x Long Natural Gas ETN (UGAZ) shed value as gas has continued to trade lower.

While this year has been difficult, I believe that we are nearing a turning point in the fundamentals. Specifically, I believe that over the coming months, we will see UGAZ reverse its past few months of declines with a strong rally in natural gas.

Natural Gas Fundamentals

To start this piece off, let’s run through the natural gas supply and demand balance to assess what variables have been impacting the market as well as form a hypothesis of where prices are likely headed.

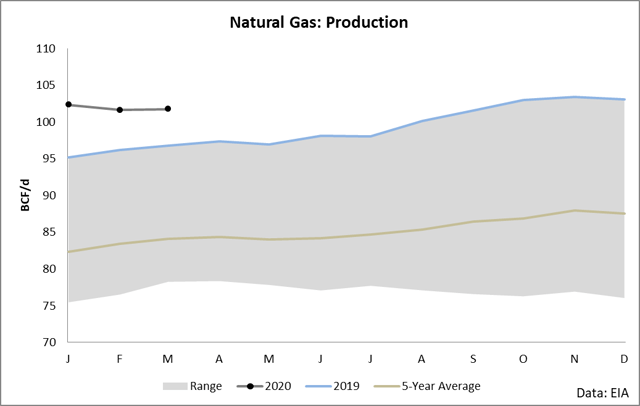

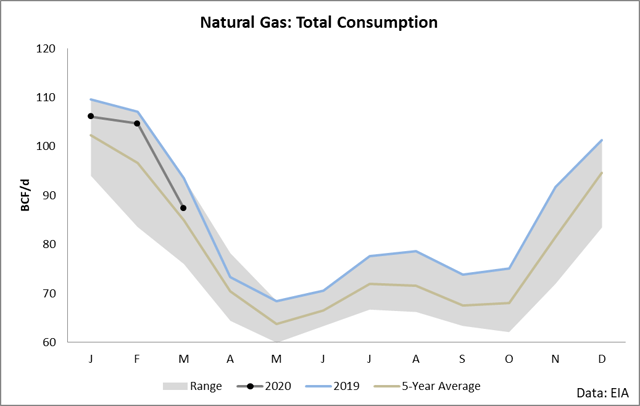

From a broad perspective, we have generally seen a good degree of weakness in the balance in the first part of this year as supply remained strong while consumption has collapsed.

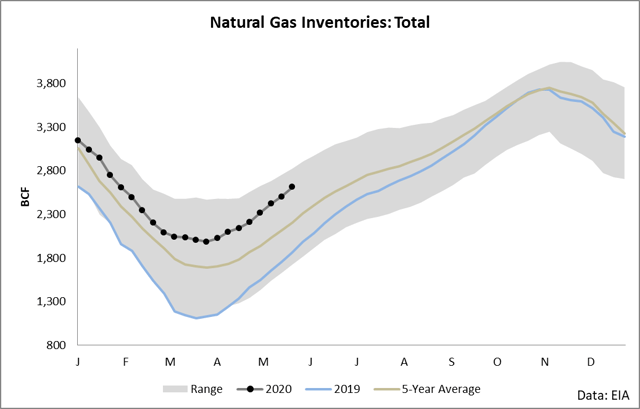

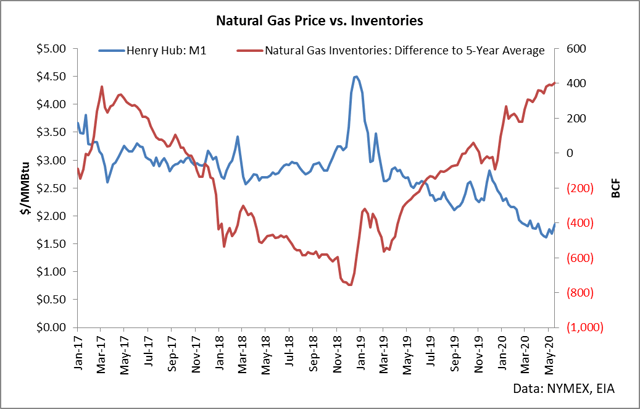

These variables have ultimately led to inventories growing against the 5-year average throughout this year.

As you can see in the chart above, the key problem for shareholders of UGAZ is that when inventories climb versus benchmarks like the 5-year average, prices tend to fall.

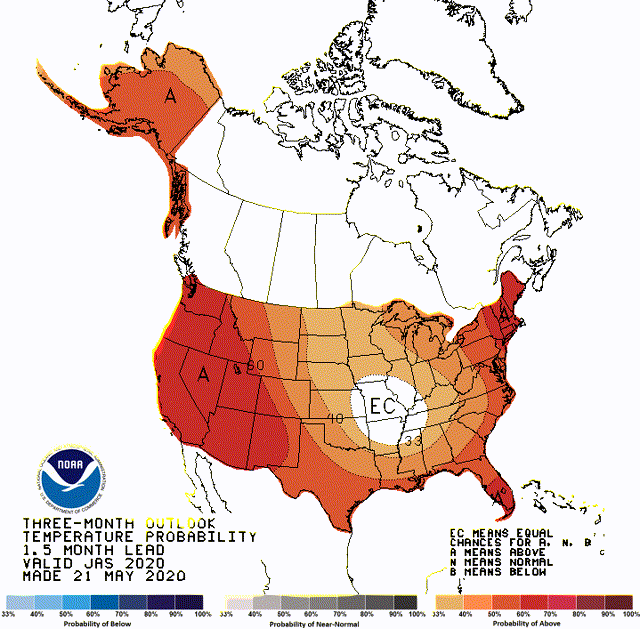

However, while this has been a difficult year in terms of supply and demand, I believe that we have two major fundamental shifts coming over the next few months which will dramatically change the balance to the bullish side. First off, we are expected to experience a hot summer.

What the above chart shows is that during summer, which is the peak time for natural gas power burn, we will see abnormally high temperatures across every major demand region. Granted, this is a weather forecast and therefore subject to revision – but if we see anything even similar to this actually materialize, we can expect to see record burn of natural gas demand for the summer period.