The last few months have seen extreme moves in asset prices. This kind of outsized market volatility has underlined the fragility of certain asset classes and investment vehicles. In this article, we compare the behavior of common and preferred shares of leveraged equity CEFs, using the Gabelli Utility Trust (GUT) as a case study.

Our main takeaway is that investors should be careful about owning highly volatile assets in leveraged CEF wrappers. This is because of the likelihood of CEF deleveraging during periods of sharp drowns, potentially locking in permanent capital loss to investors. This is a consequence of the fact that fund managers will shift their focus on prioritizing protecting holders of senior securities at the expense of common shareholders.

This has two important implications for common holders. First, even if the asset prices fully recover, the NAV of the CEF will remain below its starting point. And secondly, because the deleveraging will tend to lower the earning capacity of the CEF, it is likely to be forced to cut its distributions. This can result in an odd situation where common holders end up holding a fund that generates a lower yield on their original cost basis than the yield of senior securities.

For this reason, we prefer holding exposure to volatile asset classes either through open-end funds that have no leverage or through senior securities of CEFs.

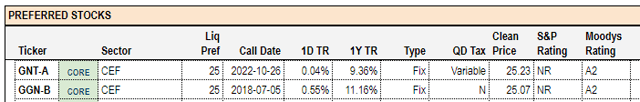

We maintain the following CEF preferreds on our Focus List:

Both series are investment-grade rated and have stripped yields of around 5% and asset coverage of over 500% in both cases.

Source: Systematic Income Focus List

CEF Leverage Recap

We often read comments here and elsewhere that say something like "CEFs must maintain their leverage below X". A quick

Check out Systematic Income and explore the best of the fund, preferred and baby bond markets with our powerful interactive investor tools.

Identify the most attractive CEFs and track the entire market with our evidence-based bespoke metrics. Pick up the best preferred stocks and baby bonds that fit your criteria.

Get investment ideas and sector views from our Strategic Allocation Framework and Income Focus List.

Check us out on a no-risk basis - sign up for a 2-week free trial!