Welcome to the valuation edition of Oil Markets Daily!

It's very difficult to buy something that keeps going up, but a broader perspective is needed in light of the strong recent performance.

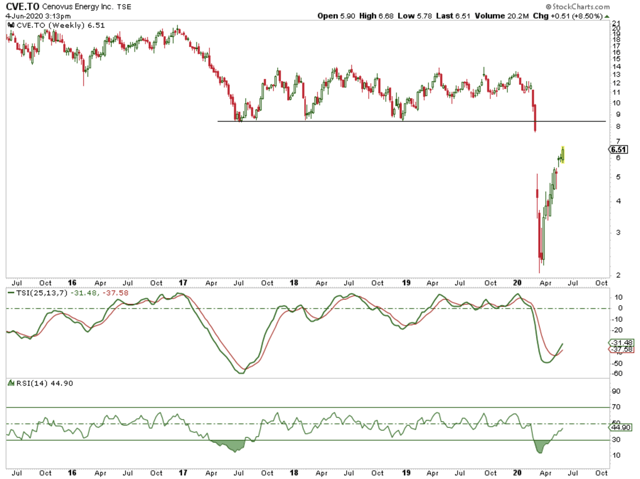

Take Cenovus Energy (CVE) for example, it has returned 187% since we bought it in March, but despite these gains, it is still down ~50% from where it was last year.

And in our mind, the recent price performance is simply correcting a material narrative shift since March.

Rewinding back to March, Saudi had just declared an oil price war following a botched OPEC+ meeting. The sudden and dramatic gap lower in energy names came as investors fretted over the coronavirus demand destruction, but also the destruction of the energy market narrative that Saudi will be the responsible producer.

Practically everyone sold and turned into a bear causing some of these energy stocks to trade to a valuation tantamount to bankruptcy. In March, the valuations got so out of whack that even solvent durable producers like Suncor (SU) traded to a valuation of ~25% FCF yield. The very same Cenovus, which didn't have any debt due in the next three years, traded to a valuation of 100% FCF yield. Meg Energy (OTCPK:MEGEF) traded above 100% FCF yield to ~140% at the very bottom.

These valuations were clearly unsustainable because it implied that oil prices will never return to $57/bbl, which was what we used as a sustainable FCF price scenario. In addition, the investment community just thought simply that global oil storages would hit tank top and cause oil prices to go to negative. Heck, even CME started getting ready for Brent to go negative, and one analyst said it's not "hard to fathom" Brent going to -$100/bbl.

Well, a month later, and none of those things happened. But instead, energy stocks

Over the weekend, we published our global oil supply and demand outlook. We see a major deficit taking shape for 2021 and 2022 in the oil market. Our oil price projection along with our supply and demand model suggests very good days ahead for the energy industry. For those interested, we are now offering a 2-week free trial for you to see for yourself. See here for more info.