As organizations across the globe become increasingly dependent on data analysis to gather insights, Alteryx (AYX) continues to grow rapidly. Alteryx provides a user-friendly data analytics platform for business intelligence. Current macroeconomic weakness leads some investors to believe the company’s momentum is permanently impaired. They are wrong. In this article, we review the business, the massive opportunity, competition, coronavirus impacts, valuation and risks. We conclude with our opinion on why Alteryx will be an absolute, post-pandemic, fortune maker stock.

(image source)

(image source)

Overview

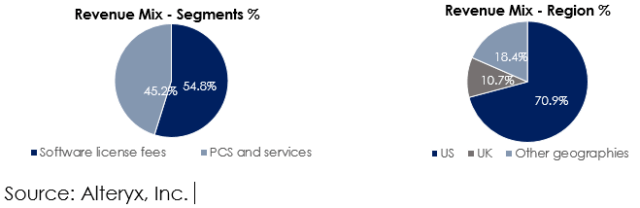

Incorporated as SRC, LLC in 1997, the company changed its name to Alteryx, Inc. in 2010 and began trading publicly in 2017. The company provides a software platform to its users to derive meaningful insights from input data for use in decision making. Alteryx’s software platform consists of over 200 in-built analytical models which enable data analysts to perform complex analytics without the need to master a sophisticated coding language. Additionally, the analytical models are open and modular and therefore coding experts can upgrade or adjust the underlying codes as per their business needs. Alteryx has both on-premise as well as SaaS based elements in its product suite, but most of the business is on-premise. It generates revenue from software licensing fees and post contract customer support which includes upgrades and other professional services. The customers typically enter into a 1-3 year subscription agreement and are billed in advance on an annual basis.

Alteryx follows a “land and expand” strategy which involves initial deployment of Alteryx designer software on a small scale at an organization and later, gradual expansion of the deployments to multiple users in the same organization. As of Q1 FY 20, the company had 6,443 customers which included 731 of the top 2,000 companies globally.

Immense long-term growth opportunity

Data analytics is increasingly becoming an