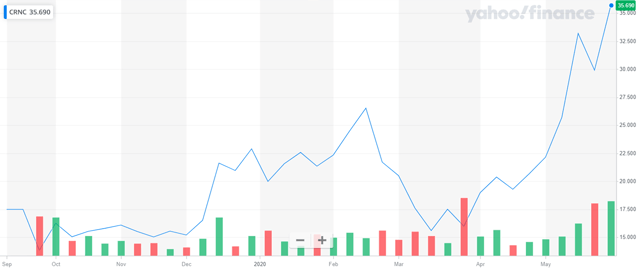

Cerence (NASDAQ:CRNC) has seen a spectacular recovery after it crashed in March 2020 and it is not without reason. This automotive-focused technology company has many things going for it in the right direction, even in current uncertain times.

A spin-off from Nuance Communications, Cerence already has more than 20 years of experience and an exceptional understanding of the possible use cases in the automotive industry. The company is in the business of developing AI-powered virtual assistants and innovations for connected and autonomous vehicles. While Cerence is already up by 83.03% YTD, I believe there remains significant upside left in the stock for 2020.

Cerence stands to emerge as a key beneficiary of increasing the adoption of connected car technology

According to MarketsandMarkets, the global connected car market will grow at a CAGR (compounded average growth rate) of 22.3% from $42.6 billion in 2019 to $212.7 billion in 2027. While the growth rate may get partly impacted by the pandemic-fueled economic downturn, this will only be a temporary phase. In fact, the increasing focus on driving regulations from authorities and rising demand for convenience, safety, and entertainment from customers, has made this a very lucrative market opportunity.

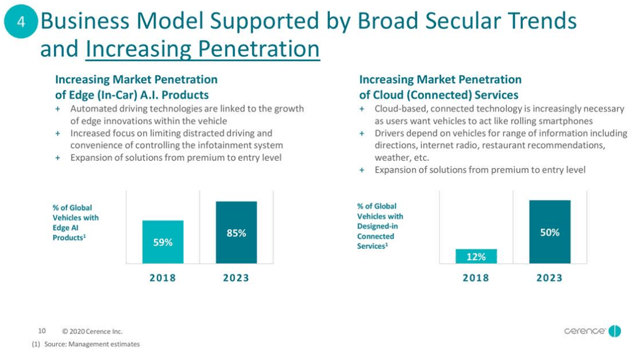

Cerence also expects rapid and broad penetration of in-car AI products and cloud-connected services by 2023.

Cerence already has a moat in this market, considering that its customer base includes all major automobile manufacturers or their tier 1 suppliers, globally. According to Bernzott Capital Advisors, the company accounts for ~80% share of the automotive embedded software technology market, while the company is winning new orders at around 90%. Cerence's tech solutions are present in 325 million cars on the road globally. In 2019, the company's solutions were included in around 50 million cars shipped globally.

Previously, Nuance Communications had been the market leader in vehicle