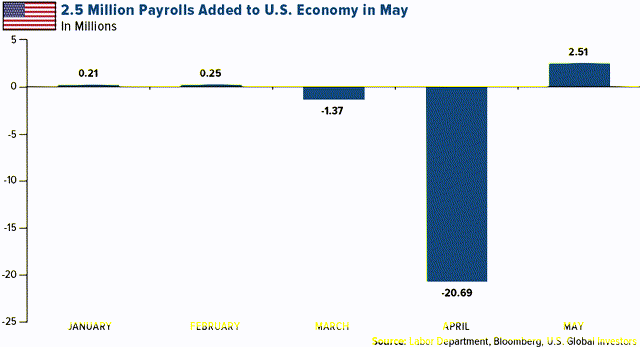

President Donald Trump addressed the blowout jobs numbers in a press conference Friday, comparing the U.S. economy to a “rocket ship.” Economists had been expecting the unemployment rate to jump higher in May, possibly to as much as 20 percent, but it ended up falling last month, from 14.7 percent in April to 13.3 percent.

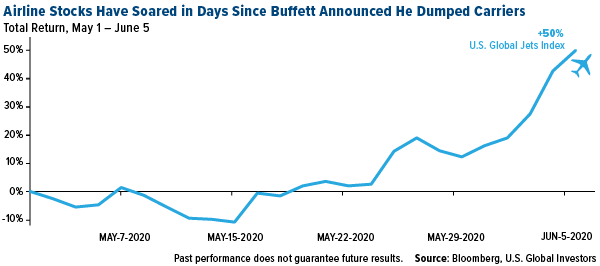

Trump praised the domestic airline industry, saying carriers are recovering nicely with the economy reopening. On Thursday, shares of American Airlines (AAL) stock exploded an unbelievable 41 percent, the most on record for a single day, after the carrier said it would increase July flights 74 percent compared with this month. Meanwhile, more and more planes are returning to the sky, with the number of parked passenger aircraft dropping below 50 percent of all fleets in the U.S., Europe and China, according to Bloomberg.

A one-time airline operator himself, Trump also singled out Warren Buffett (BRK.A) (BRK.A), who announced in early May that he sold his positions in the four major carriers due to the spread of the coronavirus.

Buffett “should have kept airline stocks because the airline stocks went through the roof today,” the president said.

He’s not wrong. I normally urge investors to follow the money, but it’s a good thing that they chose not to follow Buffett’s lead this time. Since we learned of his departure, investors have flooded into airline equities, pushing them up 53.5 percent in intraday trading Friday.

In fact, the S&P 500 Airlines Index just increased 35 percent this week alone, its “biggest on record and seven times the broader stock market’s five-day gain,” writes Bloomberg’s Nancy Moran.

A recovery in commercial air travel is well underway. At the end of each business day, the Transportation Security Administration reports on the number of passengers it screened in U.S. airports. As