Pure play cloud services companies are practically non-existent in the market - the largest cloud providers like AWS or Azure are frequently owned by large corporations. Therefore, we were very interested in Kingsoft Cloud (NASDAQ:KC) when it first IPO-ed. When we dug in more, we really liked what we saw - strong competitive advantages, a fast-growing market, and a relatively low valuation. We think all these make KC one of the best investment opportunities in this market, which is currently near all-time highs.

Attractive and growing market

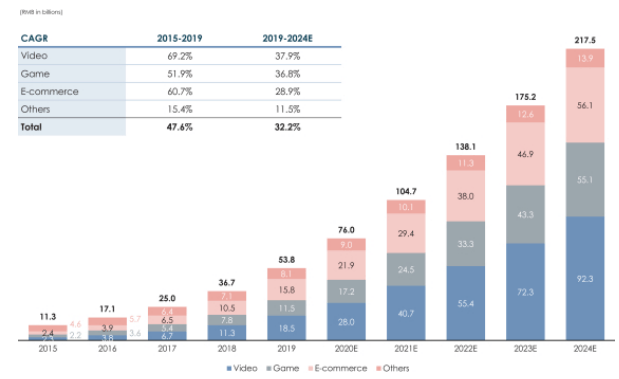

Cloud is one of the best markets to invest in over the next few years, especially the Chinese Cloud market. In China, the market is expected to grow at a CAGR of 28.3% from 2019 to 2024, quadrupling from 54bil RMB to 217bil RMB, outpacing the CAGR of 20.3% for the same period in the US, according to Frost and Sullivan (in KC registration statement).

Source: Registration Statement

The cloud market is still in its early stages with lower market penetration than that in the United States. According to Frost & Sullivan, cloud services as a percentage of total IT spending in China was 6.0% in 2019 and is expected to reach 15.8% in 2024. Meanwhile, cloud spending is 15.8% of total IT spend in the US in 2019 and is expected to grow to 33.7% of total spending by 2024.

KC has positioned itself quite early in leading verticals within the cloud space like gaming and video; both of which are expected to grow in the high 30%'s over the next 5 years. This, combined with the overall strong growth of the market, should allow KC to easily show substantial CAGR over the next few years.

Independence

KC is the third-largest internet cloud service provider in China with a market share of