Restaurateurs have been tested perhaps as much as any other group during the COVID-19 crisis. Many restaurants were shut down entirely for some period, or were operating at extremely reduced capacity, making it difficult for large and small restaurant business alike to stay afloat while waiting for a return to normal.

That includes the largest Burger King (QSR) franchisee in the US, Carrols Restaurant Group (TAST), which saw its shares plummet to under a dollar at the height of the panic. With the stock nearing $5 again, I think Carrols' history of operating issues will see earnings remain depressed for some time, and the stock is a sell.

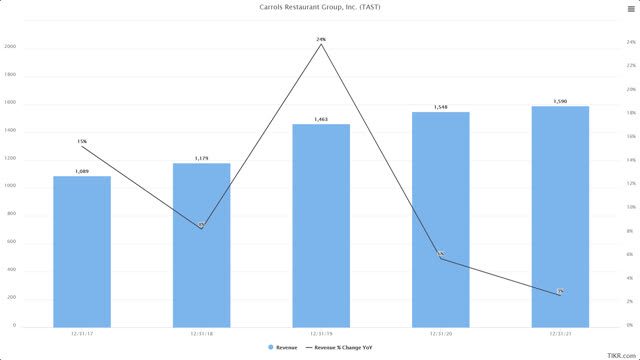

Revenue growth hasn't translated to profits

Carrols has never really had a problem generating top-line growth. The resurgence of the Burger King brand in recent years has certainly helped Carrols, but the company has done its own building of the top line by nearly constantly acquiring Burger King locations from other franchisees, or the parent company itself. Recent examples include this one, which saw Carrols gain 13 locations, and this one, which saw Carrols add 165 Burger King stores and 55 Popeyes stores, the first the chain has had outside of the Burger King brand. Note that Burger King parent Restaurant Brands International owns both Burger King and Popeyes, among others, so we may see Carrols pick up more non-Burger King stores in the future.

Source: TIKR.com

These acquisitions have led to the growth you see above, with large spikes in some years and smaller bumps in others. Carrols has done very large acquisitions at times, including the one where it picked up the Popeyes stores, and this has allowed it to build its store base to more than 1,000 Burger King stores, plus the new Popeyes stores. It operates roughly 14% of all Burger King stores