Introduction

Last month, pharmaceutical giant Sanofi (SNY) announced it closed its sale of 21.6 million shares of Regeneron (REGN) common stock with total gross proceeds of $11.7 billion. There is now growing speculation as to how the French drug company might spend the proceeds. Sanofi announced last year it will narrow its focus to immuno-oncology drugs and gene therapies. Sanofi immediately backed up those claims by acquiring Synthorx for $2.5 billion to bolster its oncology pipeline. The company may now have its eyes set on the gene therapy space. Dutch gene therapy player uniQure (NASDAQ:QURE) would be an excellent candidate giving Sanofi access to a rich IP portfolio, world-leading manufacturing facilities and a pipeline with a potential approval in hemophilia B next year.

Sanofi's new focus

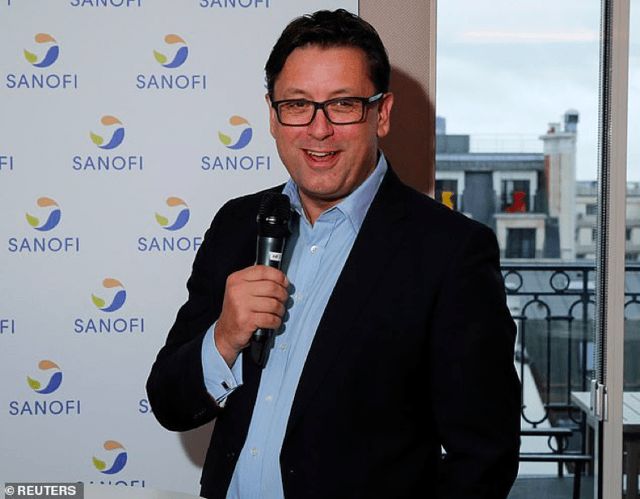

(Sanofi CEO Paul Hudson)

Sanofi CEO, Paul Hudson, immediately announced a shake-up at the firm when taking over in late 2019. The British CEO, formerly head of Novartis (NVS), announced that the company would move away from cardiovascular disease to focus on oncology, immunology, vaccines and rare diseases. Subsequently, Sanofi announced that it was eliminating 466 jobs in France and Germany, ending its cardiology research programs. Then in December 2019, Sanofi announced it would acquire San Diego, California based biotechnology company Synthorx for $2.5 billion gaining access to THOR-707, a variant of interleukin-2 (IL-2) in development to treat multiple solid tumor types. When asked about strategy for rare diseases and gene therapy on the Q1 2020 conference call, Paul Hudson stated that his contractual agreement had prevented him from being involved in the gene therapy space until end February 2020. He stated:

"Now, I can play a more active role. We are starting to get to the decision points on how we want to deploy. I can tell you there's a lot of excitement and enthusiasm. There's