Arithmetic Versus Alchemy

I’ve been having the same discussion on Twitter, and here in Seeking Alpha comments for some time now. I am repeatedly told that the Fed is pumping the stock market, and I should either just fall in line, or be outraged, or both.

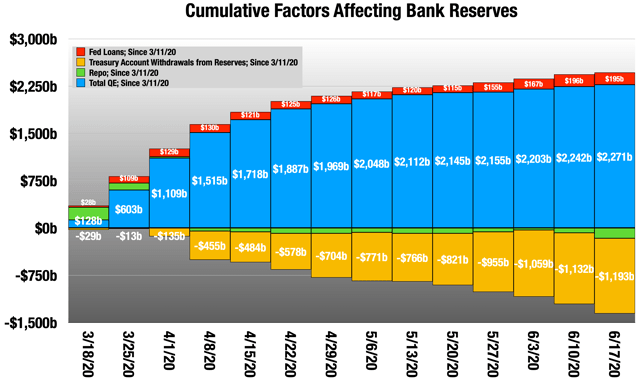

Let’s look at what has happened since the March 11 Fed balance sheet.

So far, since March 11, the Fed has pumped in $2.3 trillion to the economy in new dollars. That is mostly QE (the blue column), with an additional $195 billion in loans (the facilities), offset by a reduction in repo of $163 billion.

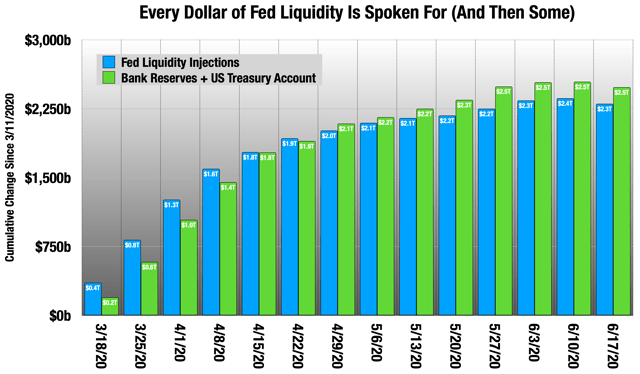

Where is that $2.3 trillion? We know exactly where it is, because it is in only two places - bank reserves at the Fed, and the US Treasury’s checking account, also at the Fed. Together, these have risen $2.5 trillion, $180 billion more than the Fed’s liquidity injections.

In addition to all the cash banks have taken from the Fed and held on to, they have also taken in an additional $180 billion in deposits that they are also holding on to. The banks are hoarding cash, not putting it to work.

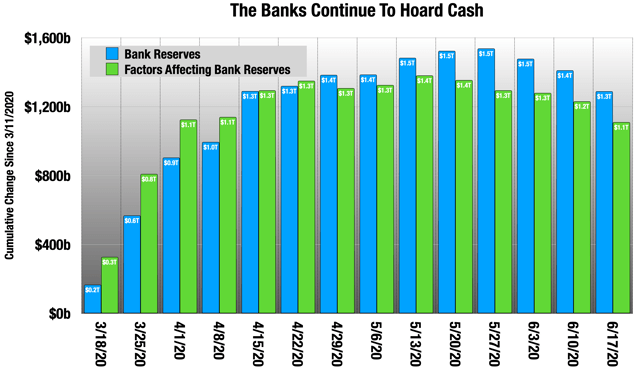

Federal Reserve. Same $180 billion difference, just another way of looking at it

Federal Reserve. Same $180 billion difference, just another way of looking at it

The takeaway should not be “OMG, buy everything!” It should be, “OMG, 3 months into this, the banks are still scared to put their money to work!”

QE1 and QE2

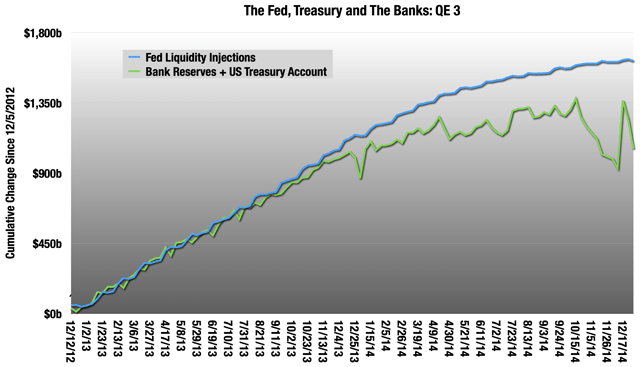

Let’s look at QE 1 and QE 2, which are instructive. QE 3 is much less helpful, because the sequester, a huge deflationary event, happened right in the middle of it and makes the whole chart run off course in 2014.

Federal Reserve. Can you tell where the sequester started?

Federal Reserve. Can you tell where the sequester started?

Keep in mind that this is all happening during