Proofpoint (NASDAQ:PFPT) has missed the recent cyber bull run, weighed down largely by short-term uncertainties related to COVID-19. Given the company’s diverse product portfolio, long-term growth prospects into new and within existing customers, and tailwinds related to work-from-home, the market seems to be over-penalizing management’s near-term guidance. Further, the significant discount at which Proofpoint is trading compared to its peers, adjusted for revenue growth and profitability, offers a great buying opportunity with long-term upside.

Rule Of 40 Screener

The Rule of 40 for software companies is a relatively new principle that the sum of a company's revenue growth rate and profitability (commonly known as efficiency) should exceed 40. This principle makes intuitive sense given that software companies pursue revenue growth at the cost of profitability. The efficiency metric is also a great rubric to holistically compare companies since the metric encapsulates several aspects of the business.

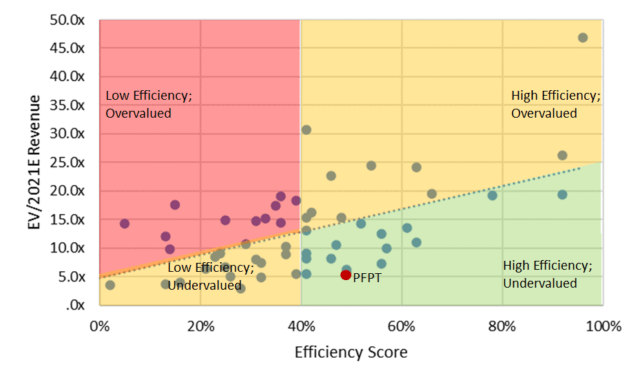

Investors generally value companies with a higher efficiency at a greater multiple. Notably, in my analysis of 56 publicly traded software companies, there is a positive correlation between EV/2021E revenue and efficiency (as measured by free cash flow margin), with an R2 of 0.32. Of this set, 27 companies with an efficiency of greater than 40 have a median EV/2021E revenue multiple of 13.5x, and 29 companies with an efficiency of less than 40 have a 30% lower median EV/2021E revenue multiple of 9.4x. These 56 companies are plotted below with efficiency on the x-axis and EV/2021E revenue on the y-axis. To clarify, the classification of overvalued and undervalued in the chart below is with respect to the trendline of the peer group.

Source: Data from Publiccomps.com; Author’s analysis in Microsoft Excel

The four quadrants in the chart above make for a great screener to dive into specific companies to understand why they are