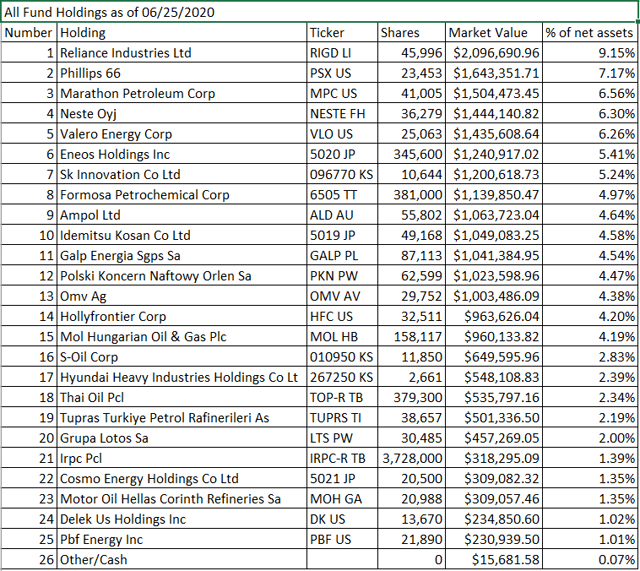

The VanEck Vectors Oil Refiners ETF (NYSEARCA:CRAK) is an investment instrument that provides investors with broad exposure to the global refining sector. Its holdings focus on merchant refiners rather than integrated oil & gas names that have large refining segments. U.S. refiners such as HollyFrontier (HFC), Marathon Petroleum (MPC), Phillips 66 (PSX), and Valero Energy (VLO) represent important components of the ETF (see table), but their influence is balanced by exposure to large foreign refiners such as India's Reliance Industries and Finland's Neste (OTCPK:NTOIF)(OTCPK:NTOIY). The ETF's expense ratio of 0.6% is offset against a TTM yield of 1.9%. The ETF's goal is to track the performance of the MVIS Global Oil Refiners Index via a full replication technique.

The benefits of CRAK's geographic diversity have been on display amid this year's immense turmoil in the refining sector. While the ETF's share price is down by a substantial 26% YTD (see figure), it has strongly outperformed the share prices of its U.S. holdings HollyFrontier, Marathon Petroleum, Phillips 66, and Valero Energy over the same period. Its rallies have been comparatively muted, but its losses have been more limited during those periods in which investors have turned bearish on the refining sector.

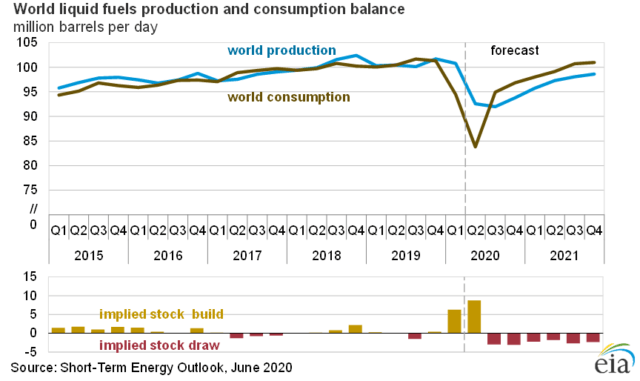

This disconnect reflects the prevailing operating environment uncertainty that is affecting the different regions within the global refining sector. The start of the COVID-19 pandemic in Q1 2020 caused global demand for refined fuels to plummet as entire economies fell under lockdown orders and cross-border travel became difficult, if not outright impossible. The rapid spread of the coronavirus around the world left refining investors with few safe harbors in the sector as every major economy quickly experienced deep refined fuels demand disruption.

Source: EIA (2020).

This is not to say that all countries have been equally impacted by the pandemic, however. China, where