ETF Overview

I have written an article to analyze the Vanguard Intermediate-Term Corporate Bond ETF (NASDAQ:VCIT) back in late 2019. Since the macroeconomic environment has changed dramatically in the past half year, it is time for me to write an article to evaluate the growth outlook of this fund again. The fund owns a portfolio of investment-grade corporate bonds in the U.S. and hence has relatively lower credit risk than other non-investment-grade corporate bonds. It has some interest rate risk since its bonds have an average effective maturity of 7.6 years. However, this risk is low given the fact that the Federal Reserve has no intention to raise interest rate at least until 2022. The ETF offers an average yield to maturity of 2.3%, and this is much higher than the U.S. Treasuries. Therefore, this is a good fund to own for investors seeking higher interest income.

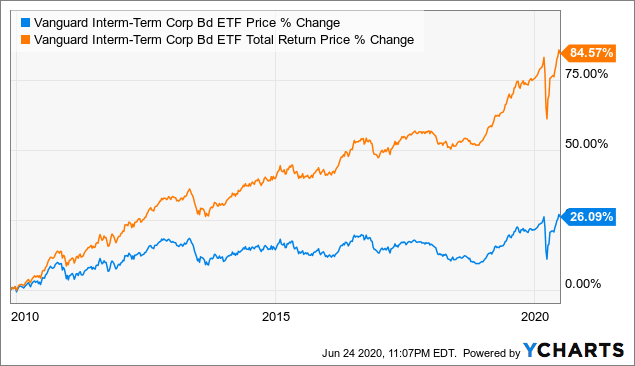

Data by YCharts

Data by YCharts

Fund Analysis

Corporate bonds face higher risk than U.S. Treasuries

VCIT tracks the Bloomberg Barclays U.S. 5-10 Year Corporate Bond Index. Unlike U.S. Treasuries that are backed by the full faith and the credit of the U.S. government, corporate bonds are not as secured because their credit ratings depend on a variety of different factors such as cash flow generated, balance sheet strength, etc. Fortunately, VCIT only invests in investment-grade corporate bonds. These bonds are much more secure than non-investment-grade bonds. In fact, investment-grade bonds' default rate is only about 0.10% per year (based on 32-year period measured). On the other hand, default rate for below-investment-grade bonds is about 4.22% per year.

Investors need to be aware that over half of VCIT's portfolio include the lowest investment-grade corporate bonds. As can be seen from the table below, these Baa bonds represent about 53.6% of its total portfolio. If the current recessionary environment continues for