Due to public health policies, we saw a sharp downturn across most of the economy in late March and April. However, with these policies having reversed somewhat, we can now see which sectors are rebounding more quickly than others. Investors want to position themselves in companies that are more likely to enjoy a “V” shaped recovery in demand than those suffering in a “U” shaped slump. Given the strong rebound in housing demand, Whirlpool (NYSE:WHR) is a company that should see solid results and is attractively valued.

Whirlpool is, of course, an appliance manufacturer, best known for its washers and dryers, though it also makes dishwashers, ovens, refrigerators, etc. Consumers are most likely to purchase appliances when purchasing a home, making WHR’s business correlated to some degree with housing demand, recognizing that there is also replacement demand as appliances age or consumers refurbish their home. Currently, it appears consumers are looking to take advantage of low rates and buy a home. In fact, applications for a mortgage to purchase a home are now higher than they were pre-COVID-19.

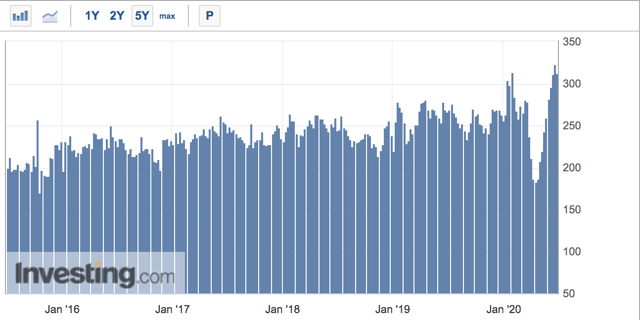

Similarly, purchases of new homes jumped by 16.6% in May. At a 676,000 pace, activity is only 1% lower than the 683,000 sold in 2019, even though much of the country still had some COVID-19-related restrictions in place. One potential driver of this demand may be consumers looking to exit dense, urban environments in favor of the suburbs. Indeed, Realtor.com reported that the discrepancy in demand between suburban and urban real estate was the second highest since 2016 last month. As suburban homes are more likely to have a full suite of appliance, in particular a washer/dryer, versus multifamily urban settings which will often have shared washers/dryers, this trend would be another tailwind for Whirlpool.

Additionally, with consumers spending so much more time