The VanEck Vectors Gold Miners ETF (GDX), launched in 2006, was the first major ETF to give investors broad exposure to the gold miners in the ETF wrapper. Since its launch, gold miner stocks have been on a wild ride.

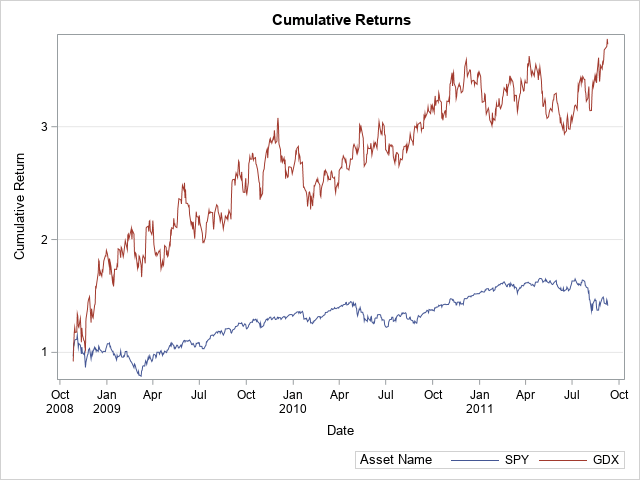

In the three bull markets since launch:

- From launch to peak in March of 2008, GDX returned over 50.5%.

- From trough in October 2008 until peak in September 2011, GDX returned 273%

- From trough in January 2016 through present, it has returned 173%.

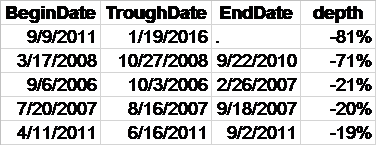

Those large upswings have come at a cost. In the last 14 years, there have been five periods where GDX lost 20% or more in value:

Obviously, investing in gold miners is not for the faint of heart. It requires timing and luck. If you are able to ride a wave up, you can make a lot of money. If you overstay your welcome, you can give it all back and then some.

On a personal note, I met Jan van Eck when seated next to him at a conference a few years back. His humble, laid-back personality belies one of the hardest working ethos on Wall Street. I highly recommend you follow him on Twitter, and his company website is a wealth of information. Barry Ritholtz had a fantastic interview with Jan on his Masters In Business Podcast.

Sprott Asset Management is one of the go-to thought leaders when it comes to resource investing. It launched the Sprott Gold Miners ETF (SGDM) in 2014. SGDM is direct competitor to GDX. Returns, as I will show later, have been in line with GDX, so the wild ride is had by both funds.

You can find more information and thought leadership from Sprott on its website (Canada and US). Rick Rule, who works for Sprott USA, is