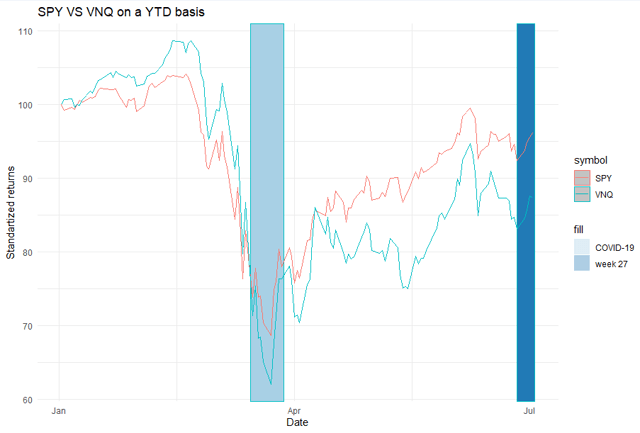

Week 27 (June 29 - July 3) finally brought positive results for the U.S. equity REITs, ending the three-week period of underperformance relative to the S&P 500.

The most direct explanation of the rally in the equity REITs is associated with the embedded "high-beta" exposure where a significant part of the REIT space has been exhibiting magnified returns since the outbreak of COVID-19.

In other words, certain REIT sectors such as hotels and retail have become much riskier due to the uncertainty around the financial prospects. The knock-on effects from the social distancing measures (e.g., temporary reduced customer flows, permanently changed consumption patterns) have essentially increased the underlying risk premiums in some of the REIT sectors. This, in turn, has driven up the beta risk - as can be seen by looking at either week 27 performance or any other week during the virus period.

Source: Verizon Media (compiled by the author)

In week 27, Vanguard Real Estate ETF (VNQ) exceeded the S&P 500 by 120 bps. However, if we compare the two indices on a YTD basis, the REITs are still down 12%, while the S&P 500 has almost reached a break even point.

Source: Verizon Media (compiled by the author)

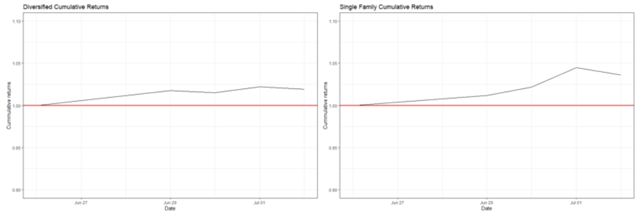

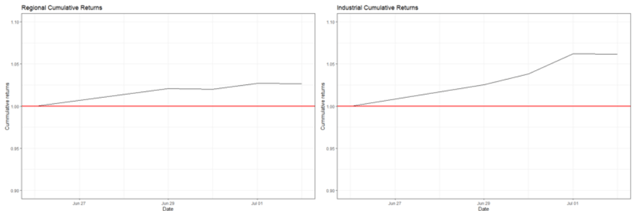

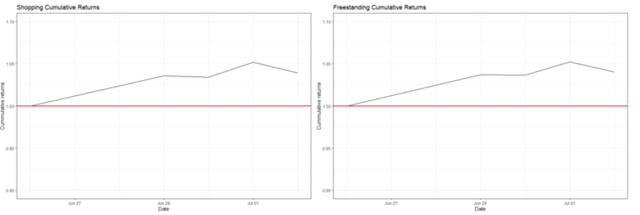

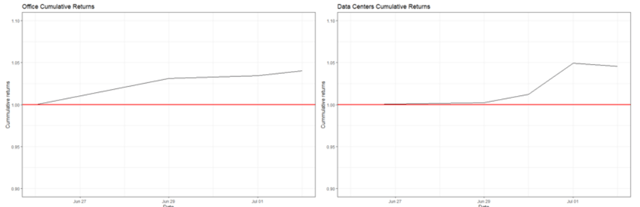

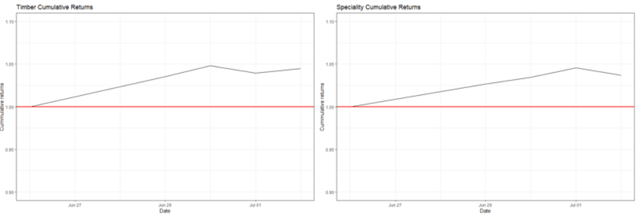

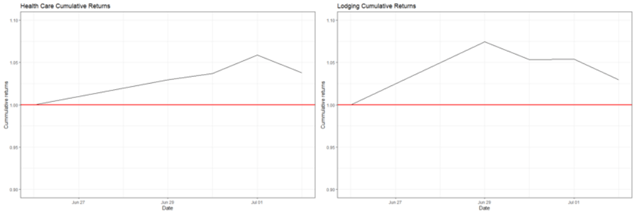

The charts above illustrate the performance of all 16 U.S. equity REIT sectors during week 27. The returns are expressed on a cumulative base factoring in any dividends paid, stock splits and/or reversals.

The key takeaway here is that finally we get to witness a fully synchronized performance across all of the 16 sectors. All 16 sectors marched higher during week 27, by registering an average return of ca. 5% (using VNQ as a proxy).

This pattern really coincides with the aforementioned thesis of REITs being loaded beta plays. Whenever the market rises (falls), the REITs exhibit significant