Introduction

The COVID-19 pandemic has brought the valuations of certain companies back to healthy levels, but in some cases where share prices haven’t bounced back from their March lows, there are some interesting opportunities. Acuity Brands (NYSE:AYI) - one of North America’s leading producers of lighting systems, for instance - still has a net cash position, was profitable in its third quarter (March-May) but on a YTD basis, its share price is still down by approximately 35%. An opportunity?

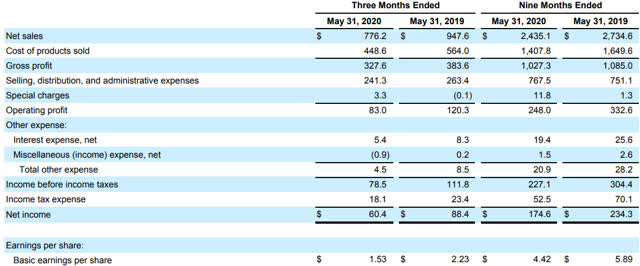

The cash flow in the first nine months of the year remains strong

In the third quarter, Acuity Brands reported a revenue of $776M, which is quite a bit lower than the $948M it generated in the same quarter last year as COVID-19 obviously had an impact on Acuity’s sales. That being said, the company’s profitability remained relatively strong: although Q3 revenue decreased by just over 18%, the COGS fell by in excess of 20% and the $170M drop in revenue resulted in a drop in the operating profit by just over $37M, or roughly a third.

Source: SEC filings

That still is substantial decrease but due to the lower net finance expenses and the lower tax bill (due to the lower pre-tax income), the net income of $60.4M still represented an EPS of $1.53/share (as the average share count slightly decreased as well.

So although the company’s Q3 was undeniably weaker than in 2019, the damage remained relatively limited and I’m looking forward to seeing the company’s Q4 results to see if Acuity was able to stabilize its revenue and profit. Due to the specific focus on North America (98% of the company’s sales are generated in North America) and the continuous COVID-19 problems in the USA, it’s perhaps too soon to expect an improvement of the financial results in

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!