If companies don't know that they can run out of money, they won't be thinking of ways not to run out of money. – Bill Gross

The capital markets are in a frenzy as the liquidity pumped in by the Fed has helped in the recovery of equity and debt markets. Some of the debt funds are performing particularly well as the rates have fallen considerably. The high-yield segment of the bond market has drawn the attention of late after the Fed went into a buying spree. The iShares Broad USD High Yield Corporate Bond ETF (BATS:USHY) is a fund that tracks this segment and has a comprehensive list of investments in its portfolio. The high-yield bond market has attracted investors who are looking for alternatives to equity investment with higher yield, and with the new Fed mandate to buy Junk bonds, somewhat lower bound-constrained.

How has the buyout from the Fed has helped?

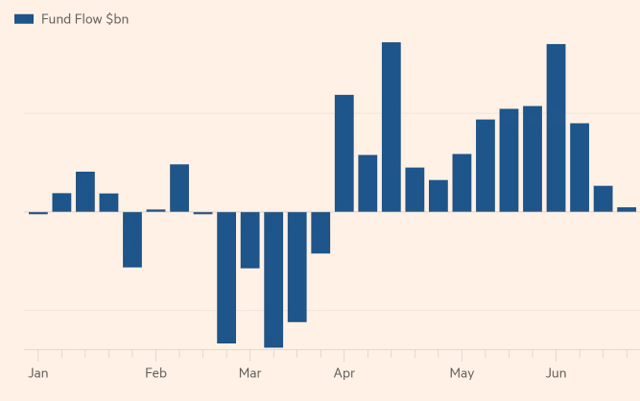

Prior to the announcement by the Fed that it would be purchasing this asset class, investors were pulling out their money from the high-yield debt market. The latter half of February and the entire March month saw net outflows. Unsurprisingly, the tide seemed to change after the Fed got involved, and there have been continuous inflows every week since the announcement.

Source: Financial Times

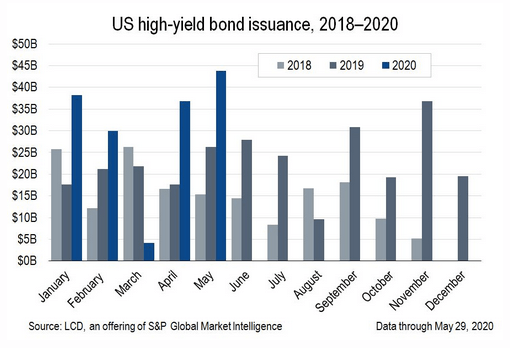

A year-on-year comparison also reveals that the announcement helped to curb any anxieties that investors had about this market. After a low in March, we see that the performance in April and May for 2020 has been significantly better than the previous two years.

Some may be critical of the demand and find it exaggerated due to the intervention of the Fed. It may seem that the liquidity provided by the central bank may not be sustainable in the longer run. However, the trajectory of

Subscribers told of melt-up March 31. Now what?

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.