In a market nearing new highs despite much of the world experiencing a sharp recession, investors may feel that there are few value opportunities. While this may be the case, shares of Marathon Petroleum (NYSE:MPC), which have lost 34% of their value over the past year, offer a compelling opportunity. This value arises from Marathon's complex business model, though a sum-of-the parts analysis points to the potential for shares to rally 70% from current levels.

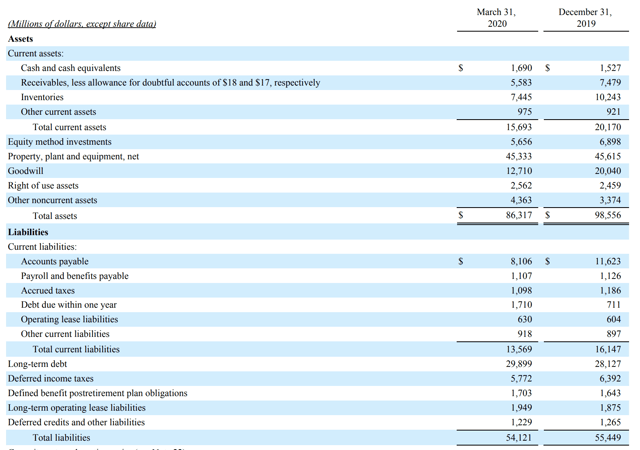

Marathon has three main units: its crude oil refining and marketing operations, its retail gas stations, and its midstream operations, housed in the publicly-traded MPLX (MPLX). As you can see below, the consolidated entity is significant with over $86 billion in assets.

(Source Marathon Petroleum)

However, these consolidated financial statements could mislead investors, because it includes MPLX, which it only owns a controlling stake in. Critically, MPLX has $20.5 billion of its own debt, which MPC does not guarantee. As such, MPC only has $11.1 billion of debt that it directly owes, despite the $30+ billion it shows on its balance sheet. Excluding MPLX, MPC has $49 billion of assets, $1.6 billion of which is cash, and $32 billions of liabilities, $11.1 billion of which is debt.

It is best to view MPC excluding MPLX's financials, and give credit for just the value of its equity stake in MPLX. With 666 million shares, at MPLX's current share price, MPC's holdings are worth $11.6 billion. MPC has a market cap of $23.5 billion and $9.5 billion of net debt for an enterprise value of $33 billion. Subtracting out its stake in MPLX, the market is valuing MPC's own operations, refining and retail, as being worth about $21.4 billion, which I believe is far too low.

Now, MPC has been looking to spin out its Speedway retail business, leaving